Bulk Payout API in India | Fast, Secure & Automated Payment Solution

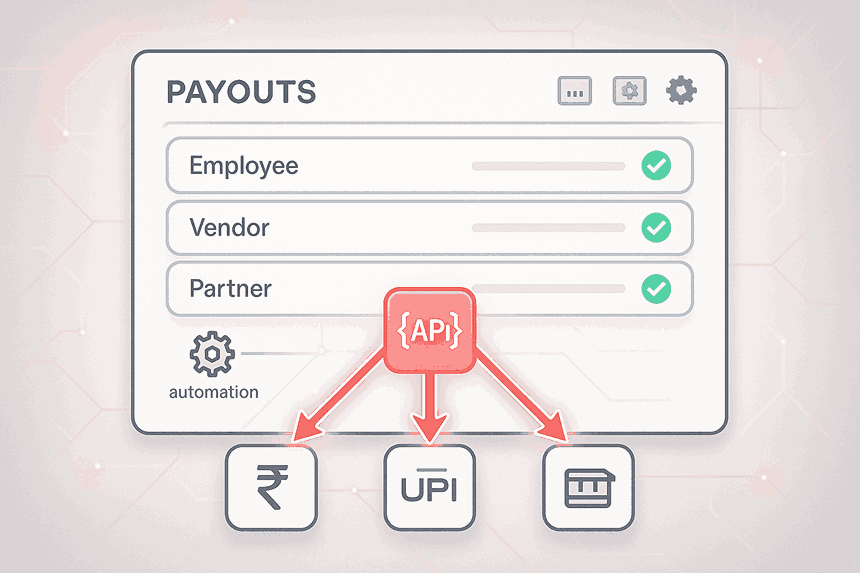

A Bulk Payout API is a payment automation tool that helps businesses send multiple payments to different recipients instantly. Instead of manually processing hundreds of transactions, companies can automate payouts with a single API request. Think of it as pressing one button and paying hundreds of vendors, employees, riders, or customers at once. To explore more business payment solutions, check out our SprintNXT Payments Platform

Table of Contents

How Does a Bulk Payout API Work?

Why Bulk Payout APIs Are Growing in India?

Key Features of a Bulk Payout API

How Bulk Payout API Benefits Businesses?

Who Uses Bulk Payout APIs in India?

Bulk Payout API vs Traditional Payment Systems

How to Integrate a Bulk Payout API?

Important Security Measures

Top Use Cases of Bulk Payout API in India

Choosing the Right Bulk Payout API Provider

Future of Bulk Payout APIs in India

Conclusion

FAQs

How Does a Bulk Payout API Work?

Bulk Payout API connects your business system to a bank or fintech provider. You upload or send payment data ? the API processes payments ? recipients get their money instantly. To learn more about how bulk payments work, explore our detailed guide here: What Is Bulk Payment?

Why Bulk Payout APIs Are Growing in India

Rise of Digital Payments

With UPI and digital banking, India has seen massive payment digitization. Businesses need faster, more reliable ways to pay users.

Increasing Need for Payment Automation

Manual tasks slow operations. Automation reduces errors and speeds up transactions.

Faster Settlements for Businesses

Payout APIs help companies maintain smooth cash flow and deliver instant payments, something customers now expect.

Key Features of a Bulk Payout API

Real-Time Transfers

Funds are transferred instantly to recipients via UPI, IMPS, or wallets.

Multi-Channel Payment Options

Most APIs support:

UPI

NEFT

RTGS

IMPS

Wallet payouts

High Security & Compliance

Banks and fintech companies use encrypted channels, tokenization, and strict authentication measures.

Dashboard & Reporting Tools

Businesses get real-time insights on:

Payment status

Failed transfers

Bank responses

Settlement reports

How Bulk Payout API Benefits Businesses

Saves Time & Operational Costs

Automation reduces the need for manual reconciliation and data entry.

Reduces Human Error

No accidental double payments or missing entries.

Enhances Customer & Vendor Experience

Faster payouts build loyalty and trust.

Simplifies Large-Scale Transactions

Perfect for businesses managing thousands of daily payouts.

Who Uses Bulk Payout APIs in India?

E-commerce Platforms

To manage seller payouts and refunds.

NBFCs & Fintech Companies

For loan disbursement and KYC-approved client payments.

Gig Economy Apps

Ride-hailing, food delivery, and courier companies for daily payouts.

Insurance & Loan Companies

Instant claim settlements and reimbursements.

Corporations & Payroll Teams

To automate salaries, stipends, and incentives.

For a deeper understanding of how Bulk Payment APIs are transforming enterprise transactions, read our full blog here: Bulk Payment API: Transforming Enterprise Transactions

Bulk Payout API vs Traditional Payment Systems

Manual Processing vs Automation

Traditional banking requires manual uploads, whereas APIs automate everything.

Instant Settlements vs Delays

APIs ensure real-time payments compared to slow NEFT/RTGS batches.

Better Control & Transparency

Every transaction can be tracked live with responses and logs.

How to Integrate a Bulk Payout API

API Documentation

Developers use the provider’s documentation for integration.

Testing in Sandbox

Transactions are tested with dummy data to avoid live risks.

Going Live

Once approved, the API is connected to the production environment.

Monitoring & Optimization

Businesses monitor performance, response time, and success rate.

To explore more on how digital payment systems work, check out our blog on UPI Collection

Important Security Measures

Two-Factor Authentication

Ensures only authorized users can initiate payouts.

IP Whitelisting

Restricts access to trusted networks.

Encryption Standards

Protects sensitive financial information.

Top Use Cases of Bulk Payout API in India

Vendor Payouts

Pay multiple vendors without manual processing.

Salary & Freelancer Payments

Automate monthly payroll and gig worker payouts.

Refunds & Cashback

E-commerce and apps use APIs for instant refunds.

Loan Disbursements

NBFCs rely on payout APIs for instant loan approvals and disbursals.

Choosing the Right Bulk Payout API Provider

Success Rate

Look for high uptime and successful transaction percentages.

Pricing & Transaction Fees

Compare per-transaction cost and volume-based discounts.

Customer Support Quality

24/7 support is essential for payment-critical operations.

Scalability

Choose a system that handles millions of payouts smoothly.

Future of Bulk Payout APIs in India

AI-Based Fraud Detection

AI tools will detect unusual patterns and prevent fraud.

Faster UPI Growth

UPI Lite, UPI AutoPay, and upcoming innovations will boost payouts even more.

Increased Automation

More businesses will adopt fully automated financial systems.

Conclusion: Bulk Payout API

The Bulk Payout API system is transforming business payments in India. It’s fast, secure, and ideal for companies managing high-volume transactions. Whether you're a fintech startup, an enterprise, or an e-commerce brand, adopting a payout API can significantly improve efficiency, reduce costs, and deliver better customer experiences. To explore more financial solutions for growing businesses, check out our blog on the best business banking solutions for startups in 2025.

FAQs: Bulk Payout API

What is a Bulk Payout API in India?

It’s an API that automates sending multiple payments instantly to different recipients.

Can small businesses use payout APIs?

Yes, even small companies can automate vendor and employee payments.

Are payout APIs secure?

Yes, they use encrypted channels, authentication, and bank-grade security.

Which payment modes are supported?

UPI, IMPS, NEFT, RTGS, bank transfers, and wallet payouts.

Do payout APIs reduce operational costs?

Absolutely! Automation saves time and reduces the need for manual work.