The BULK Payment API Revolution: 10 Ways It Transforms Businesses

Bulk Payment

APIs are changing the way businesses handle transactions at scale. From payroll

to refunds, to vendor and NGO disbursements, the ability to automate, track,

and secure high-volume payments is now a vital edge. With innovations in API

technology, organizations of any size can deliver funds faster, improve

compliance, and dramatically reduce manual errors. Let’s explore the many ways

Bulk Payment APIs revolutionize enterprise payments and financial management.

Table of Contents

1.

Bulk

Payment API Use Cases

2.

Integrating

Bulk Payment API with Your System

3.

Bulk

Payment API vs. Traditional Banking Solutions

4.

Future

of Bulk Payment APIs

5.

Conclusion

6.

FAQs

About Bulk Payment API

Bulk Payment API Use Cases

Bulk Payment

APIs show their true power in versatility. Businesses across industries—from

fintech startups to multinational corporations—use them to simplify operations.

Let’s explore the most impactful use cases.

Salary Disbursements

1.

Salaries

are credited on the exact date.

2.

Errors

from incorrect account details are minimized.

3.

Payslips

and notifications are generated automatically.

This frees

HR teams from repetitive tasks and allows them to focus on employee engagement.

Vendor and Supplier Payments

1.

Recurring

vendor settlements can be scheduled.

2.

Partial

payments can be automated based on delivery milestones.

3.

Example:

E-commerce platforms auto-release payments once delivery is confirmed, building

trust and strengthening partnerships.

Refunds and Customer Payouts

1.

E-commerce:

Instant order refunds.

2.

Insurance:

Quick claim settlements.

3.

Gaming:

Instant withdrawals of winnings.

Speedy

refunds mean fewer complaints and happier customers.

Government and NGO Disbursements

1.

Transparency:

Real-time reports aid audits.

2.

Efficiency:

Funds reach recipients without delays.

3.

Security:

Account validation reduces fraud.

They are

transforming financial inclusion globally.

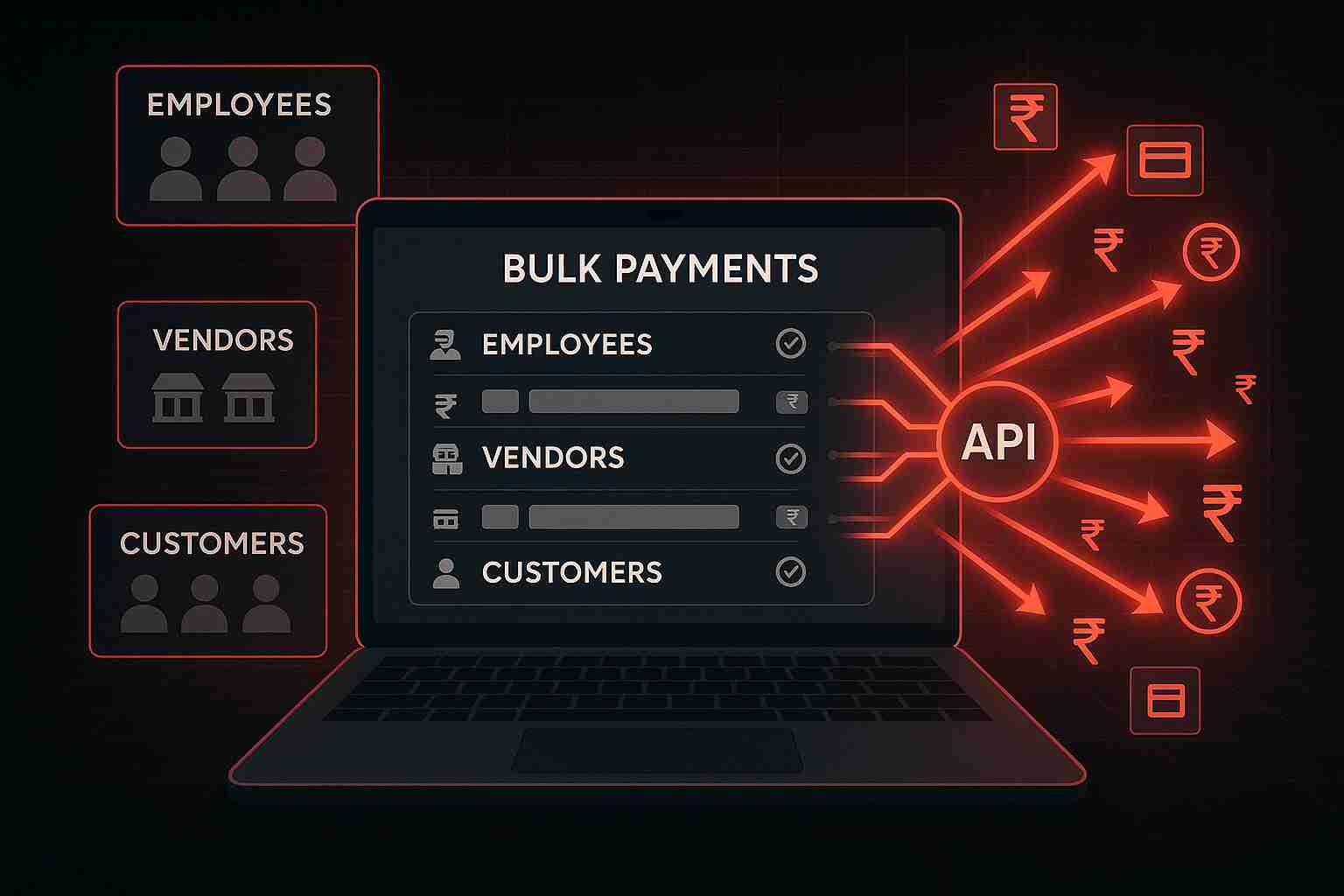

Integrating Bulk Payment API with Your System

API Documentation and SDKs

1.

Most

providers offer detailed docs, SDKs, and ERP plugins.

2.

Developers

can easily connect apps to APIs for seamless financial workflows.

Sandbox Testing and Deployment

1.

Companies

test integrations in sandbox mode before going live.

2.

Edge

cases like failed transactions or downtime are handled in advance, ensuring

smooth deployment.

Bulk Payment API vs. Traditional Banking Solutions

Speed and Automation

1.

Traditional

Banking: Manual uploads, 2–3 days settlement.

2.

Bulk

Payment API: Instant or same-day payments, fully automated.

Transparency and Tracking

1.

Traditional

Banking: Limited visibility post-upload.

2.

Bulk

Payment API: Real-time dashboards, transaction IDs, and webhook alerts.

Result: APIs

are faster, smarter, and far more reliable.

Future of Bulk Payment APIs

AI and Predictive Analytics

1.

AI-driven

APIs will predict payment trends.

2.

Detect

fraud in real-time.

3.

Ensure

compliance—minimizing financial risks.

Blockchain-Driven Payments

1.

Blockchain

integration will enable faster, cheaper, and transparent international payouts.

2.

Will

revolutionize cross-border bulk transactions.

Conclusion

The Bulk

Payment API isn’t just a tool—it’s a revolution in financial management. By

automating payouts, reducing errors, and enabling real-time settlements, it

empowers businesses to scale seamlessly.

From

employee salaries to vendor settlements, refunds, and welfare schemes — APIs

deliver efficiency, speed, and transparency.

As digital

adoption accelerates, Bulk Payment APIs will soon shift from being an advantage

to being a necessity. Businesses that embrace them early will enjoy stronger

compliance, better efficiency, and higher customer satisfaction.

FAQs About Bulk Payment API

What is a Bulk Payment API?

A Bulk

Payment API is a tool that automates and executes multiple payments at once,

reducing errors and saving time.

Is Bulk Payment API secure?

Yes. APIs

use encryption, tokenization, and standards like PCI-DSS for safe transactions.

Can small businesses use Bulk Payment APIs?

Absolutely.

They are affordable and help even small firms automate finances.

How does a Bulk Payment API improve customer satisfaction?

By enabling

instant refunds, fast payouts, and error-free transactions.

Do Bulk Payment APIs work internationally?

Yes. Many

providers integrate with global banks and fintechs for cross-border payments.

What industries benefit most from Bulk Payment APIs?

E-commerce,

fintech, insurance, logistics, government, and NGOs benefit the most.