Choosing the Right Payment Gateway for Indian Businesses with SprintNXT

Payment Gateway for Indian Businesses is no longer just a backend utility—it’s a critical growth enabler in today’s digital-first economy. Businesses—from e-commerce stores and online marketplaces to service platforms—depend on reliable payment gateways to accept customer payments smoothly and securely. A payment gateway bridges your website or app with banks and multiple payment methods, encrypting transaction data and managing authorizations to ensure payments are completed without friction.

SprintNXT stands out as a payment gateway solution built specifically for Indian businesses, offering multi-PG integration, UPI collections, fast settlements, and a unified dashboard that combines collections with automated payouts and actionable insights. This guide explores what payment gateways do, their types, key selection factors, and how SprintNXT delivers commercial-grade performance for modern digital operations.

This performance is enabled through API-driven banking and payment infrastructure that connects gateways, banks, and business systems into a single operational layer.

Table of Contents

What is a Payment Gateway?

Why Choosing the Right Payment Gateway Matters

How Payment Gateways Work

Types of Payment Gateways

Key Factors for Selecting a Payment Gateway

SprintNXT: Payment Gateway with Connected Banking

Payment Gateway Comparison Table

Conclusion

Frequently Asked Questions

What is a Payment Gateway?

A payment gateway is software that securely transmits payment information between a customer's bank and your business's acquiring bank, managing online transactions across cards, UPI, net banking, and wallets. It encrypts sensitive data, authorizes payments, and confirms success or failure in seconds.

For Indian businesses, gateways like SprintNXT support local favorites such as UPI, RuPay cards, and wallets alongside international options, ensuring broad customer reach. SprintNXT's gateway emphasizes multi-PG routing to boost uptime and success rates.

Gateways with UPI-first collection capabilities are especially critical for Indian checkout flows and customer preference.

Why Choosing the Right Payment Gateway Matters

The ideal payment gateway directly influences security, customer retention, and revenue growth. Poor choices lead to cart abandonment, fraud losses, or high fees, while the right one streamlines checkout and scales with your business.

Key impacts include:

Security and trust: PCI DSS compliance and fraud tools protect data and build customer confidence.

Conversion rates: Fast, multi-option checkouts reduce drop-offs.

Cost efficiency: Competitive fees and same-day settlements optimize cash flow.

Scalability: API support enables global expansion and integrations.

Gateways that integrate settlements with automated payout systems help businesses improve liquidity and reduce manual finance operations.

How Payment Gateways Work

Payment gateways follow a structured process to ensure secure, efficient transactions.

Customer initiates payment

Enter card/UPI/wallet details at checkout.

Data encryption and authorization

Gateway encrypts info and sends it to the acquiring bank, then the issuing bank for approval.

Approval/decline

Issuing bank checks, funds/fraud; response routes back via gateway.

Confirmation and settlement

Success notifies merchant/customer; funds settle into account (often same-day with SprintNXT).

Types of Payment Gateways

Businesses choose based on integration needs and scale.

Hosted: Redirects to the provider's page; simple, secure, but less branded.

Self-Hosted: Keeps customers on-site; more control, but requires PCI compliance.

API-Based: Deep integration for custom flows; ideal for platforms.

Multi-PG: Routes via multiple gateways for higher success.

Key Factors for Selecting a Payment Gateway

Evaluate providers on these essentials:

Security

PCI DSS, SSL/TLS encryption, 3D Secure, and AI fraud detection.

Payment Methods

UPI, cards, net banking, wallets, EMI/BNPL; multi-currency for growth.

Fees

Transaction rates (e.g., 2% + fixed), setup/monthly costs, settlements.

Integration

APIs, SDKs, plugins for Shopify/WooCommerce; developer support.

Support & Uptime

24/7 help, analytics, same-day settlements.

Businesses planning scale should prioritize gateways that integrate seamlessly with connected business banking platforms like SprintNXT

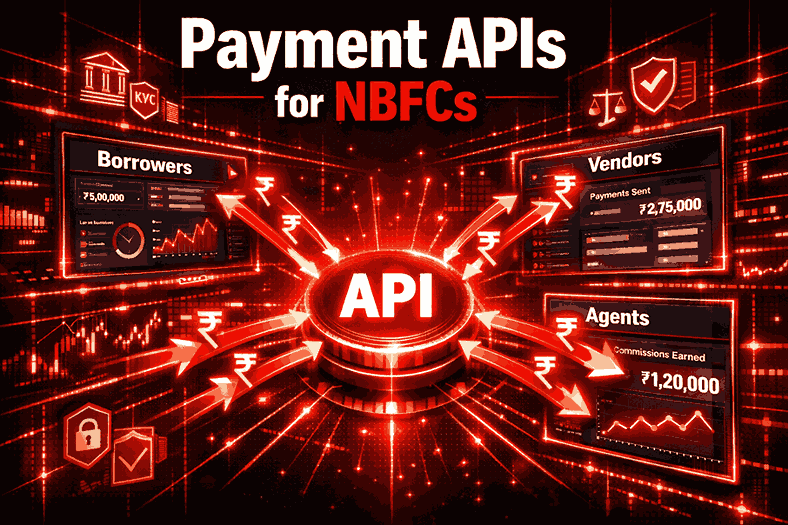

SprintNXT: Payment Gateway with Connected Banking

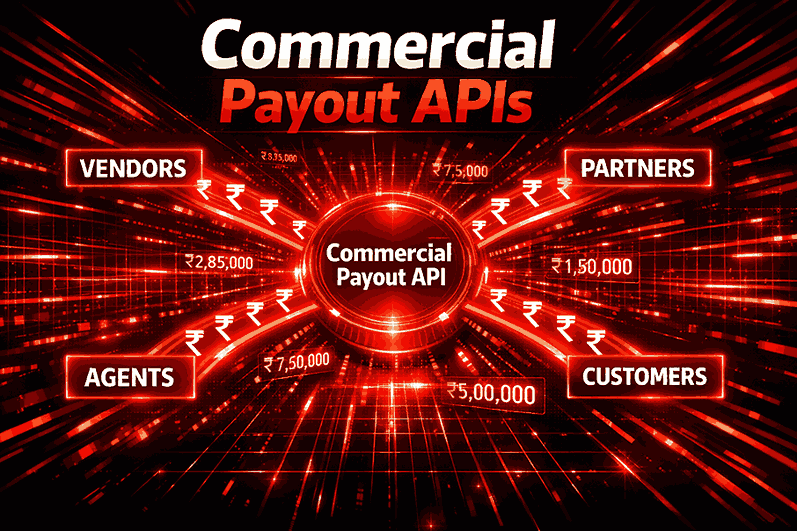

SprintNXT goes beyond basic gateways by combining collections with payouts, reconciliation, and multi-bank orchestration.

Multi-PG routing: Connects 4+ gateways for 99%+ uptime and success.

UPI & multi-mode: Instant collections via UPI, cards, net banking.

Fast settlements: Same-day across PGs for better liquidity.

API-driven: Seamless for apps, marketplaces, e-commerce.

Full stack: Includes payouts and insights, unlike pure gateways.

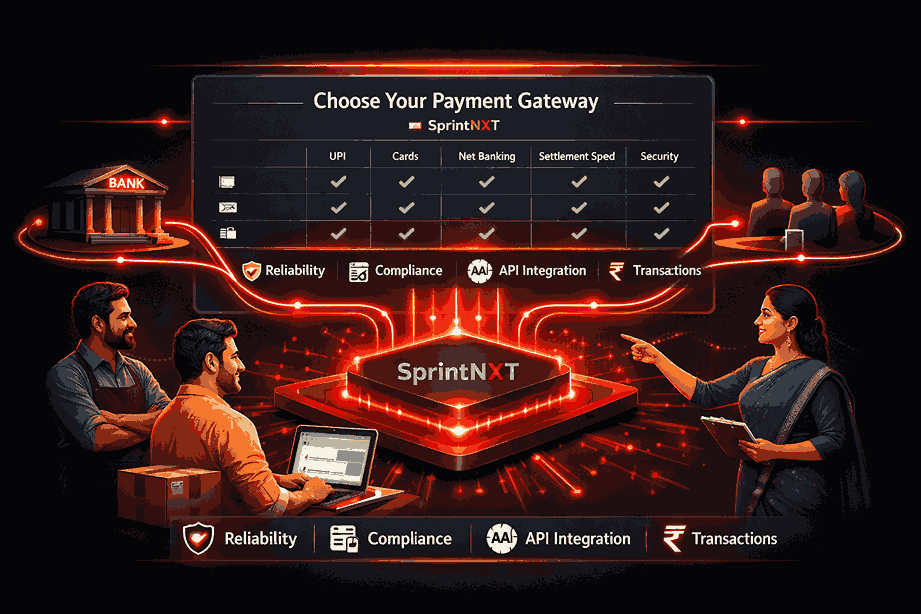

Payment Gateway Comparison Table

| Provider | Integration Ease | Transaction Fees | Security | Settlements | Multi-PG |

| SprintNXT | API/SDK/Plugins | Competitive | PCI DSS, Fraud Detection | Same-Day | Yes |

| Razorpay | High | 2%+ | Strong | T+1 | No |

| PayU | Medium | Variable | High | T+1 | Limited |

| Stripe | Developer-Focused | Moderate | Advanced | T+2 | No |

| CCAvenue | Plugins | Higher | Compliant | T+1 | No |

Conclusion

Selecting the optimal payment gateway secures transactions, boosts conversions, and fuels expansion in India's dynamic digital market. Prioritize security, fees, methods, and integration while comparing options thoroughly.

SprintNXT delivers a robust gateway with multi-PG reliability, same-day settlements, and connected banking—empowering businesses to accept payments effortlessly while automating the full financial lifecycle.

Businesses can explore integration or onboarding by contacting SprintNXT directly

Frequently Asked Questions

What is a payment gateway?

Software that securely processes online payments by encrypting data and coordinating between customer/merchant banks.How does SprintNXT differ from traditional gateways?

SprintNXT offers multi-PG routing, same-day settlements, and integrated payouts/reconciliation beyond collections.What security should a gateway provide?

PCI DSS compliance, encryption, 3D Secure, and fraud detection tools.Are API-based gateways better for scale?

Yes, they enable custom integrations and high-volume processing.How do fees work?

Typically, percentage, fixed per transaction, plus setup/settlement costs; compare models.