Commercial Payout APIs for NBFCs and Vendors with SprintNXT

NBFCs and large enterprises in India handle massive volumes of outward payments-loan disbursals, vendor and partner payouts, commissions, and refunds-all of which directly impact customer experience and business growth. When these flows depend on manual net-banking uploads and spreadsheets, they become a bottleneck, slow down growth, and increase risk.

A commercial-grade API stack for NBFC disbursement and vendor payment automation can transform payouts from a back-office chore into a strategic advantage. Platforms like SprintNXT give NBFCs, fintechs, and enterprises a single, connected layer to orchestrate disbursals and vendor payments across multiple banks with speed, control, and analytics.

This orchestration is powered by API-first banking infrastructure that connects internal systems directly to banking rails.

Table of Contents

Why NBFCs Need Disbursement APIs

Vendor Payment Automation in India: The Commercial Case

How NBFC Disbursement APIs Work in Practice

Key Business Benefits of API-Led Disbursals and Vendor Payments

SprintNXT as a Commercial Payout Layer for NBFCs and Enterprises

High-Value Use Cases in the Indian Market

Implementation Roadmap for NBFCs and Enterprises

Conclusion

Frequently Asked Questions

Why NBFCs Need Disbursement APIs

NBFCs in India disburse loans to thousands of customers daily—personal loans, BNPL, consumer durable loans, SME finance, and more. Traditional methods like manual file uploads to bank portals or semi-automated systems are slow, error-prone, and difficult to scale as volumes grow.

A disbursement API allows NBFCs to:

Trigger loan disbursals instantly from their LOS/LMS when loans are approved.

Choose disbursement modes (IMPS, NEFT, RTGS, UPI) based on ticket size, urgency, and cost.

Get real-time status on success, failure, or reversal, enabling quick corrective action.

This is critical for NBFCs competing on turnaround time (TAT) and customer experience in an increasingly digital lending marketplace.

NBFCs that integrate automated payout systems gain a strong advantage in turnaround time and borrower satisfaction.

Vendor Payment Automation in India: The Commercial Case

Enterprises in India work with a wide vendor base—suppliers, agencies, logistics partners, technology vendors, and freelancers—each expecting timely and transparent payments. When vendor payments are done via manual NEFT uploads and approvals, finance teams spend disproportionate time on low-value tasks, and vendors suffer from delays and mismatched references.

Commercially, automating vendor payments helps to:

Preserve vendor relationships by paying on time and with clear references.

Reduce working capital leakage due to duplicate payments or errors.

Provide management with accurate, real-time visibility into payables and cash positions.

An API-led vendor payment engine connected to internal ERPs and SprintNXT-style infrastructure directly addresses these needs.

How NBFC Disbursement APIs Work in Practice

A typical NBFC disbursement API flow integrated with a business banking switch like SprintNXT looks like this.

Loan approval in LMS

The customer loan is approved in the NBFC’s loan management system with the final amount, bank details, and disbursement type.

API call to the disbursement platform

The LMS sends an API request with borrower details, amount, mode (IMPS/NEFT/RTGS/UPI), and a unique reference ID.

Routing via the connected banking layer

The connected platform routes the transaction through the NBFC’s mapped current account with partner banks.

Real-time response and webhooks

The API returns a success/failure response, and webhooks push updates as the transaction moves through banking rails. The LMS updates the loan status accordingly.

Automated reconciliation

All disbursements are reconciled against bank statements and internal ledgers, with clear mapping to loan IDs.

This architecture drastically reduces TAT, removes manual steps, and keeps audit trails clean.

Key Business Benefits of API-Led Disbursals and Vendor Payments

Done right, NBFC disbursement APIs and vendor payment automation deliver tangible commercial value.

Faster go-to-market and scale: NBFCs and fintechs can launch new products and scale disbursal volumes without linear increases in operations staff.

Lower operational costs: Automation reduces time spent on data entry, approvals, and manual reconciliation across teams.

Better risk and compliance control: A centralized API layer enforces maker-checker rules, whitelisting, limits, and audit logs across all payouts.

For enterprises, this directly translates into stronger vendor ecosystems and better internal controls.

SprintNXT as a Commercial Payout Layer for NBFCs and Enterprises

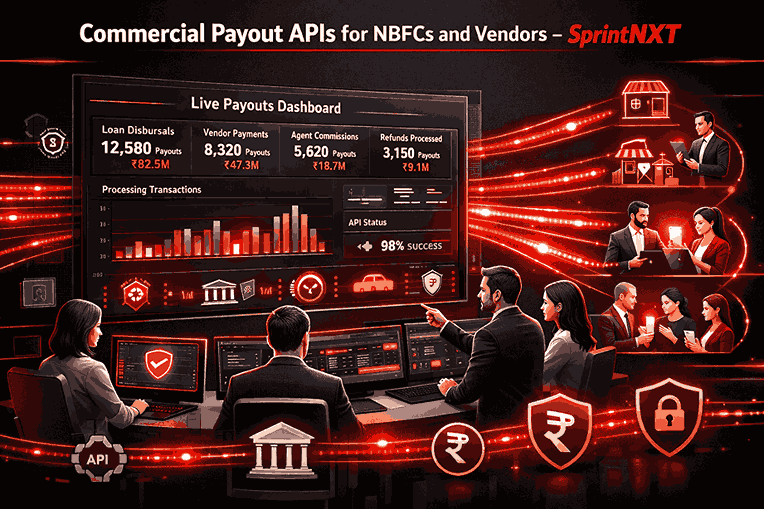

SprintNXT is designed as a connected business banking platform that orchestrates payouts, collections, and reconciliation across multiple bank accounts via APIs. For NBFCs and vendor-heavy enterprises, it serves as a commercial payout engine rather than just a transaction facilitator.

Commercially relevant capabilities include:

NBFC disbursement APIs: Instant or scheduled disbursals via IMPS, NEFT, RTGS, and UPI triggered directly from LOS/LMS, with real-time status updates.

Vendor payment automation: Bulk and recurring vendor payments executed through a unified API interface while drawing from one or more current accounts.

Multi-bank setup: Support for multiple partner banks through a single integration, giving flexibility on pricing, risk, and redundancy.

By centralizing these capabilities, SprintNXT helps NBFCs and enterprises build robust, scalable payout infrastructure aligned with commercial growth goals.

These capabilities are delivered through SprintNXT’s unified business banking platform, abstracting multiple banks into a single payout layer.

High-Value Use Cases in the Indian Market

API-led disbursement and vendor automation apply across several high-value verticals in India.

Digital lenders and NBFCs

Instant loan disbursals to bank accounts or UPI IDs on loan approval, with automatic reconciliation against loan accounts.

B2B marketplaces and supply-chain finance

Automated vendor and supplier payouts based on invoice approvals or early-payment discount programs.

Enterprise procurement and shared services

Centralised payment hubs that execute payouts to thousands of vendors across entities using one SprintNXT-style platform.

Agency, franchise, and partner networks

Recurring payouts of commissions, incentives, and revenue shares to distributed partners on a periodic schedule.

Implementation Roadmap for NBFCs and Enterprises

To adopt NBFC disbursement APIs and vendor payment automation effectively, organisations can follow a structured approach.

Map current payout processes

Detail all payout flows: loan disbursals, vendor payments, commissions, refunds, and their volumes and pain points.

Prioritise high-impact journeys

Start with loan disbursement (for NBFCs) and high-volume vendor payments where delays or errors hurt most.

Integrate with an API-based payout platform

Connect core systems (LMS/ERP/TMS) to a connected banking layer like SprintNXT through secure APIs.

Define rules, limits, and controls

Set up workflows for approvals, limits per transaction/user, and whitelisting of beneficiaries to align with internal risk policies.

Monitor performance and optimize

Track settlement times, failure rates, and partner satisfaction, and refine rules and processes accordingly.

Conclusion

Commercially, NBFC disbursement APIs and vendor payment automation are no longer optional—they are essential infrastructure for lenders and enterprises that want to scale, control risk, and deliver a superior experience to customers and partners. Manual, fragmented payout processes cannot keep up with the speed and volume demands of India’s digital economy.

SprintNXT provides a commercial-grade, API-first payout layer that brings together NBFC disbursals and vendor payments under one roof, across multiple banks, with strong reconciliation and controls. For NBFCs and enterprises in India, this is the foundation for building scalable, future-ready financial operations.

Frequently Asked Questions

What is an NBFC disbursement API?

An NBFC disbursement API lets a loan management system trigger loan disbursals directly through banking rails (IMPS/NEFT/RTGS/UPI) programmatically, without manual net-banking steps.How does vendor payment automation work in India?

Vendor payment automation connects ERPs or finance systems with an API-based payout platform so that approved invoices trigger payouts automatically, with real-time status and reconciliation.Why should NBFCs move to API-led disbursals?

API-led disbursals reduce turnaround time, minimize manual errors, improve customer experience, and enable NBFCs to handle higher volumes without increasing operations staff proportionally.How can SprintNXT help with vendor payments?

SprintNXT allows enterprises to upload or send vendor payout instructions via APIs and execute payments across multiple banks and modes while providing dashboards and reconciliation tools.Is multi-bank support important for commercial payouts?

Yes, multi-bank support offers better pricing, redundancy, and flexibility, allowing businesses to route payouts as per cost, speed, or risk preferences.