Payment API for NBFCs: How SprintNXT Simplifies Digital Payments

A Payment API for NBFCs is a secure system that allows Non-Banking Financial Companies to automate loan disbursements, EMI collections, bulk payouts, and transaction reconciliation by connecting their platforms directly with banking and payment networks.

Table of Contents

Why NBFCs are adopting Payment APIs

How Payment APIs Support Loan Operations

Core payment use cases for NBFCs

How SprintNXT supports Payment APIs for NBFCs

Is SprintNXT suitable for large NBFC operations?

How Payment APIs improve compliance and reporting

Frequently Asked Questions

Conclusion

Why NBFCs are adopting Payment APIs

NBFCs manage large volumes of loan transactions every day. Manual payment handling increases delays, errors, and operational costs.

Payment APIs enable NBFCs to process payments more efficiently while ensuring accuracy and compliance.

They help lending companies handle growing transaction volumes without increasing manual workload.

Learn more about: Payouts

How Payment APIs support loan operations

Payment APIs integrate directly with an NBFC’s core lending system.

Typical workflow:

Loan amount is triggered for disbursement via API

Funds are transferred through banking rails

The transaction status is received instantly

Repayments are automatically matched with loan accounts

Read the full article: Complete UPI Collection API

Core payment use cases for NBFCs

Loan Disbursements:

NBFCs can release loan amounts instantly to borrower bank accounts, reducing approval-to-disbursal time.

EMI and Repayment Collections:

Automated collections through UPI and bank transfers help NBFCs receive repayments on time with fewer failures.

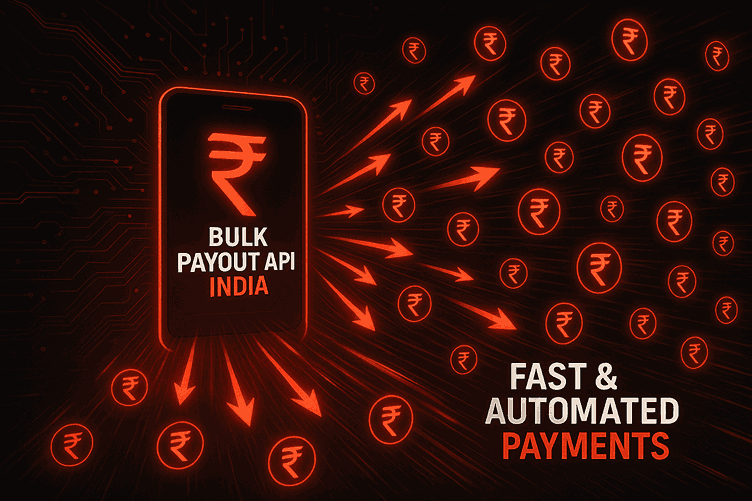

Bulk Payouts:

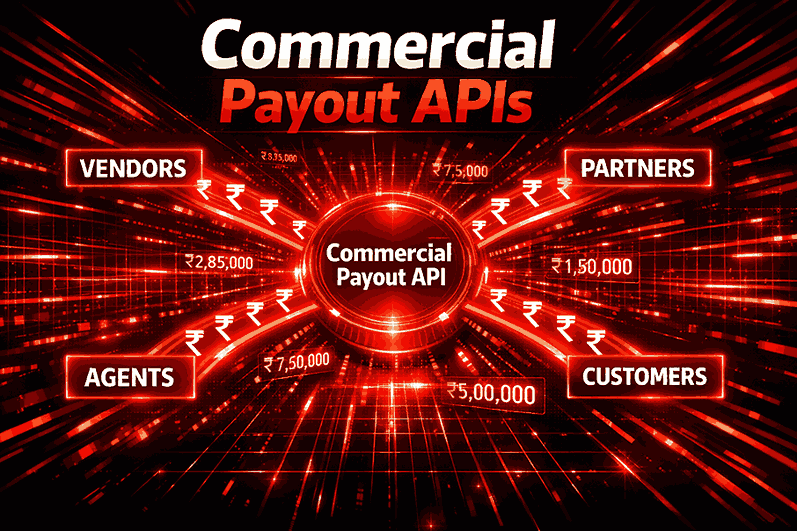

Payment APIs enable mass payouts to agents, vendors, and partners using a single integration.

Transaction Tracking and Reconciliation:

Each payment is tracked in real-time and reconciled automatically, minimizing the need for manual intervention.

How SprintNXT supports Payment APIs for NBFCs

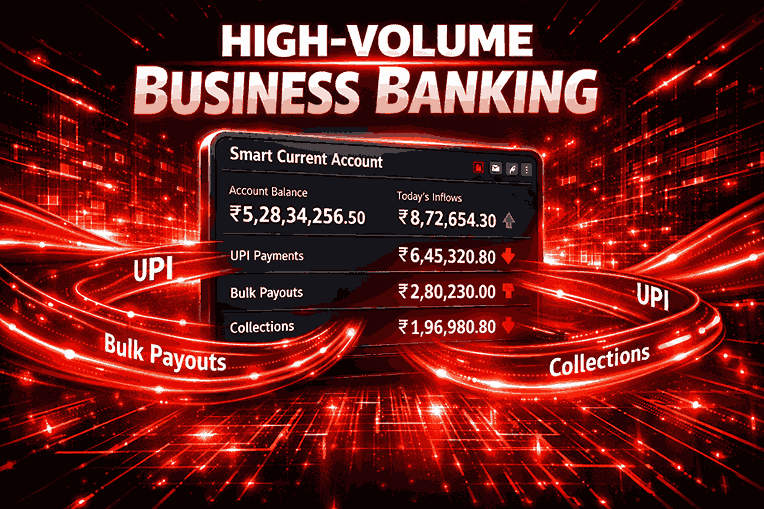

SprintNXT provides Payment APIs designed to support high-volume NBFC payment workflows.

With SprintNXT, NBFCs can:

Automate loan disbursements and collections

Execute bulk payouts efficiently

Track transactions in real time

Maintain secure and compliant payment operations

Integrate quickly with existing systems

Is SprintNXT suitable for large NBFC operations?

Yes. SprintNXT is designed for NBFCs that handle thousands of daily transactions, making it suitable for both growing and established lending institutions.

Read more about: What is UPI Autopay

How Payment APIs improve compliance and reporting

Payment APIs maintain detailed transaction records, real-time logs, and audit-ready reports. This helps NBFCs meet regulatory requirements and simplifies internal reporting processes.

Learn more about: Best Business Banking Platform for Indian SMEs

Conclusion

Payment APIs play a critical role in modern NBFC operations by enabling fast, automated, and secure payment processing. With SprintNXT’s Payment APIs, NBFCs can streamline lending workflows and manage digital payments at scale.

Frequently Asked Questions

How do Payment APIs help NBFCs scale?

Payment APIs enable NBFCs to manage increasing transaction volumes without introducing manual processes or operational complexity.

Can Payment APIs reduce payment failures?

Yes. Real-time status updates and automated reconciliation help identify and resolve failed transactions quickly.

Are Payment APIs secure for NBFC transactions?

Payment APIs utilize encrypted connections and adhere to financial security standards to safeguard transaction data.