Smart Current Accounts for High-Volume Business Banking – SprintNXT

A current account is a business-focused bank account designed for frequent, high-volume transactions, offering unlimited deposits and withdrawals, no interest, and, often, overdraft facilities. This makes it ideal for businesses, firms, and professionals managing day-to-day operations like vendor payments, salary disbursals, and customer collections, unlike savings accounts that are optimized for personal savings and interest.

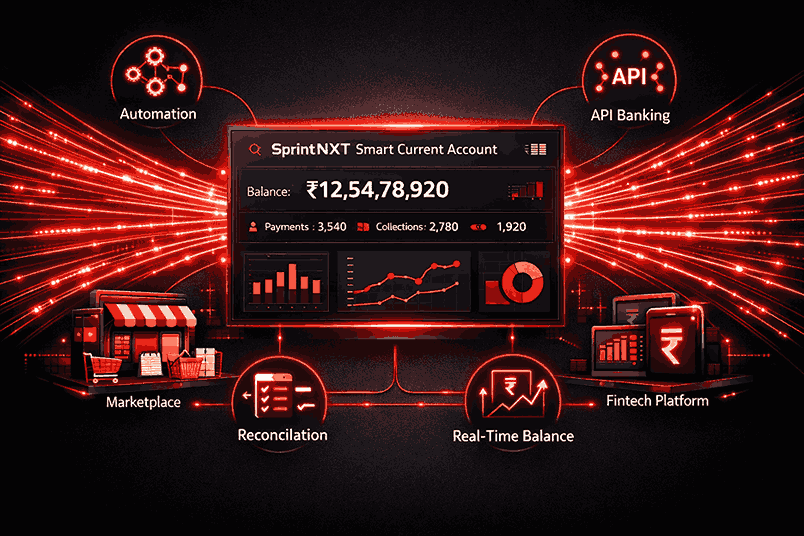

SprintNXT positions itself as a business banking switch that sits on top of traditional current accounts, giving companies a unified way to control and automate payments, collections, and reconciliation across multiple banks through a single interface and set of APIs. This turns the conventional current account into a programmable, insight-driven tool instead of just a passive place to park funds.

This approach aligns with how modern businesses use API-driven banking infrastructure to scale payments and reconciliation without changing their underlying bank relationships.

Table of Contents

What is a Current Account?

Why Businesses Use Current Accounts Over Savings Accounts

Limitations of Traditional Current Accounts

How SprintNXT Enhances Business Current Accounts

SprintNXT Features Built Around Current Account Usage

Use Cases: Current Account + SprintNXT in Daily Operations

How to Modernize Your Current Account Setup with SprintNXT

Conclusion

Frequently Asked Questions

What is a Current Account?

A current account is a type of bank account tailored for businesses that need to handle frequent, high-volume transactions rather than earn interest on idle balances. It usually offers unlimited deposits and withdrawals, cheque facilities, and often overdraft limits that help manage working capital cycles.

Unlike savings accounts, which are meant for individuals and have restrictions on transaction volumes and patterns, current accounts are designed to support day-to-day business operations like vendor payments, bulk payouts, invoice collections, and salary processing. This makes them the default choice for MSMEs, corporates, startups, and professional firms.

For businesses receiving customer payments digitally, UPI-based collection systems integrated with current accounts significantly improve speed and traceability.

Why Businesses Use Current Accounts Over Savings Accounts

Businesses choose current accounts because they prioritize liquidity, flexibility, and transaction capability over interest earnings. Companies need to pay suppliers, receive client payments, settle GST, and meet payroll obligations without worrying about withdrawal limits or penalties.

Current accounts also support higher transaction ceilings, integration with payment instruments (like cheques, RTGS/NEFT/IMPS, and UPI handles), and features like overdraft, which help manage short-term cash-flow gaps. For a serious business, a savings account simply cannot support the scale and speed required in operations.

As payment volumes grow, businesses increasingly automate settlements using bulk and automated payout systems instead of manual net banking.

Limitations of Traditional Current Accounts

While essential, a traditional current account by itself is largely manual and siloed. Businesses often:

Operate multiple current accounts across different banks with separate logins, formats, and reporting views.

Depend on manual uploads, spreadsheets, and reconciliations to match inflows and outflows with invoices, customers, or vendors.

Struggle with real-time visibility into balances and transactions across accounts, especially as volume and complexity grow.

This fragmentation leads to operational friction, higher finance overhead, delayed decisions, and increased chances of error in payouts or reconciliation.

How SprintNXT Enhances Business Current Accounts

SprintNXT acts as a connected banking platform that brings multiple current accounts together into one programmable layer. Instead of logging into each bank separately, businesses plug their current accounts into SprintNXT and manage collections, payouts, and reconciliation from a unified dashboard and API stack.

Key enhancements include:

Unified control: View and manage balances, transactions, and payment workflows across different banks from a single place.

API-led automation: Replace manual file uploads and net banking operations with API-based collections and payouts linked directly to your ERP, app, or marketplace backend.

Smart reconciliation: Automatically match incoming and outgoing transactions to orders, invoices, or customers, reducing the workload on finance teams.

SprintNXT Features Built Around Current Account Usage

SprintNXT is designed specifically for how Indian businesses actually use their current accounts every day. It layers the following capabilities on top:

Collections via UPI and virtual identifiers

Accept payments into your linked current accounts using UPI, virtual accounts, and other digital rails, while tracking who paid, for which invoice, and when.

Automated payouts and bulk disbursals

Send salaries, vendor payments, marketplace settlements, or refunds from your current accounts at scale using automated payout APIs instead of manual net-banking.

Multi-bank flexibility

Connect current accounts from different partner banks and switch routing based on cost, speed, or business rules, without rewriting your internal systems.

These features effectively turn the current account into a “smart node” inside a larger financial operations system rather than a standalone bank product.

Use Cases: Current Account + SprintNXT in Daily Operations

With SprintNXT plugged into existing current accounts, multiple operational workflows become faster and more reliable.

Marketplaces and platforms

Use linked current accounts as master settlement accounts, while SprintNXT handles incoming customer payments and automated payouts to sellers or partners, with full reconciliation.

NBFCs and lenders

Use current accounts for loan disbursals and collections, while SprintNXT automates pay-outs, EMIs, and reconciliation across thousands of borrowers.

Education, travel, and subscription businesses

Route fees and subscription collections into current accounts through UPI/virtual accounts, and use payout rails for refunds, vendor settlements, or commissions.

Growing SMEs and startups

Centralize all current account activity and automate recurring payments (rent, utilities, vendor bills) and receivables, improving cash flow visibility.

How to Modernize Your Current Account Setup with SprintNXT

Businesses can move from basic banking to connected banking in a few clear steps.

Map your current accounts

List all existing current accounts, their banks, purpose (collections, payouts, escrow, etc.), and pain points like manual reconciliation or limited visibility.

Integrate with SprintNXT

Connect these accounts to SprintNXT via available integrations and APIs, so that collections, payouts, and statement data start flowing into a single platform.

Automate key journeys

Identify high-volume journeys—like vendor payouts, salary runs, customer collections, or marketplace settlements—and move them from manual net banking to SprintNXT APIs.

Use dashboards and analytics

Leverage SprintNXT’s dashboards to monitor balances, track transaction patterns, identify bottlenecks, and improve working capital decisions.

For consultation, integration support, or onboarding guidance, businesses can contact SprintNXT directly.

Conclusion

Current accounts are the backbone of business banking, built for frequent, high-volume transactional activity rather than passive savings. They empower businesses, firms, and professionals to manage daily operations, but in isolation, they often remain manual and fragmented.

SprintNXT transforms traditional current accounts into connected, programmable assets by unifying multiple bank relationships, automating collections and payouts, and delivering real-time reconciliation and insights. For modern Indian businesses and marketplaces, this combination of current accounts plus SprintNXT enables scalable, controlled, and intelligent financial operations.

Frequently Asked Questions

What is a current account in simple terms?

A current account is a business bank account designed for frequent, high-volume transactions, offering unlimited deposits and withdrawals, typically without interest, for daily operational use.How is a current account different from a savings account?

A savings account is meant for individuals to save and earn interest with limited transactions, while a current account is designed for businesses to handle large volumes of day-to-day payments and collections, usually without interest but with more flexibility.Who should open a current account?

Businesses, startups, MSMEs, companies, partnerships, and professionals like consultants or firms that regularly receive and make payments related to business activities should use current accounts.Does a current account offer overdraft facilities?

Many current accounts come with overdraft or credit line facilities, allowing businesses to temporarily withdraw more than the available balance to manage short-term cash flow, subject to bank approvals and limits.How does SprintNXT work with existing current accounts?

SprintNXT connects to your existing current accounts and provides APIs and dashboards so you can manage collections, payouts, and reconciliation across different banks from a single, connected platform.