Smarter Collections with Virtual Account IDs by SprintNXT

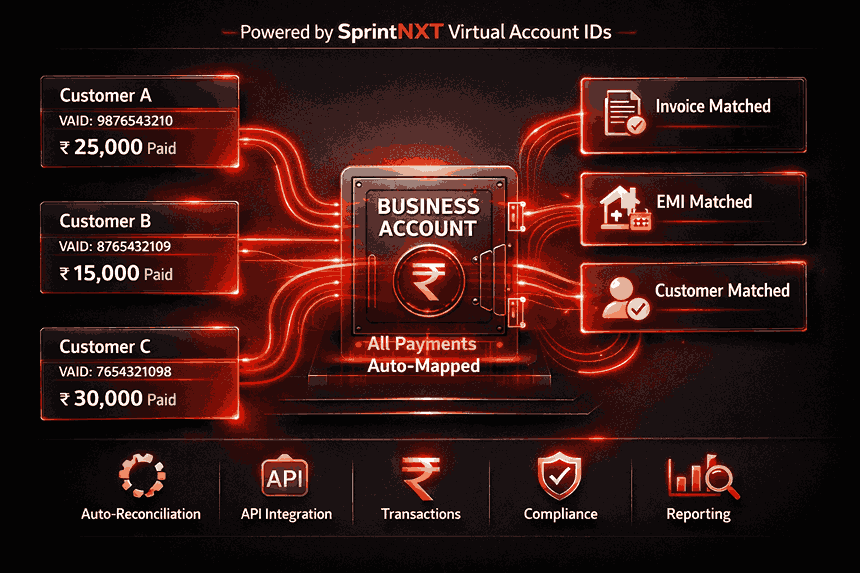

Virtual account IDs (also called virtual payment addresses or collection IDs) are unique identifiers linked to your main business bank account, simplifying collections by automatically tagging incoming payments to specific customers, invoices, or orders. Unlike generic account numbers that mix all funds together, each virtual ID creates a "digital sub-account" for precise tracking without actual account proliferation.

For Indian businesses—from marketplaces and SaaS platforms to NBFCs and logistics firms—SprintNXT's virtual account solution makes collections faster, reconciliation automatic, and cash flow visibility instant, eliminating manual matching headaches.

This automation is powered by API-first banking infrastructure that links virtual IDs directly to collections, reconciliation, and downstream workflows.

Table of Contents

What Are Virtual Account IDs for Payments?

Why Virtual Accounts Simplify Collections

How Virtual Account IDs Work Step-by-Step

Key Benefits for Businesses and Customers

SprintNXT Virtual Accounts: Collections Made Smart

Real-World Use Cases Across Industries

Implementation Guide for Virtual Account Collections

Conclusion

Frequently Asked Questions

What Are Virtual Account IDs for Payments?

Virtual account IDs are unique alphanumeric identifiers (like VA12345678) mapped to your primary current account, enabling customers to pay directly into it while the bank or payment platform automatically attributes funds to the right invoice, customer, or transaction.

When a customer pays via UPI, IMPS, NEFT, or net banking to their assigned virtual ID:

Funds land in your master account.

The system instantly tags the payment with metadata (customer name, invoice number, amount).

No manual reconciliation needed—everything matches automatically.

Virtual IDs are most effective when combined with UPI-first collection systems that support instant attribution and payer identification.

Why Virtual Accounts Simplify Collections

Traditional collections force businesses to:

Share the same account number with all customers, mixing payments.

Manually match bank statements against invoices using Excel or accounting software.

Chase customers for references or payment details.

Virtual account IDs solve this by:

Auto-attribution: Each payment carries built-in customer/transaction context.

Zero reconciliation effort: 100% match rate between bank credits and receivables.

Customer convenience: Simple UPI/NEFT transfers without complex forms or portals.

How Virtual Account IDs Work Step-by-Step

The virtual account collection flow is elegant and event-driven.

ID generation

Business creates virtual IDs for customers, invoices, or use cases via API/dashboard.

Customer payment

Customer pays to their unique ID (UPI, NEFT, IMPS) with your business name as beneficiary.

Instant routing & tagging

Payment hits master account; system auto-matches to customer/invoice via virtual ID.

Real-time notification

Webhook/API notifies your ERP/CRM of receipt with full details (amount, customer, reference).

Auto-reconciliation

Payment marked "collected" in accounting; ledger updates without manual intervention.

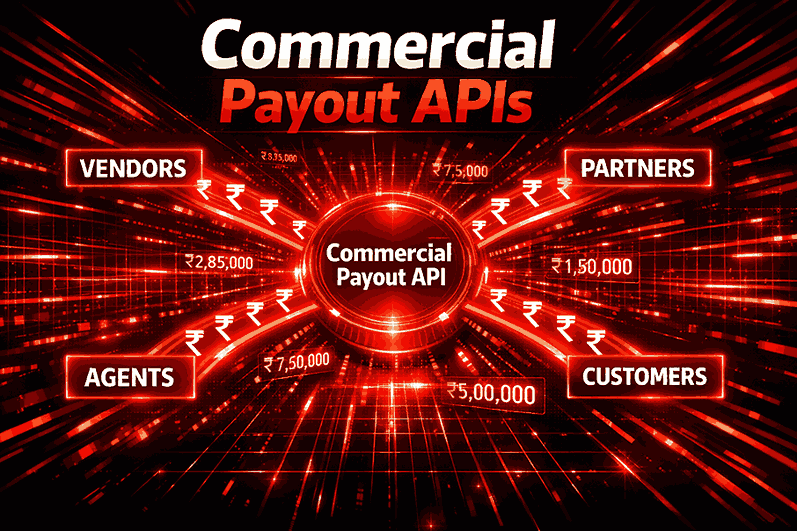

At scale, these events can trigger automated settlement and payout workflows across vendors, partners, or sellers.

Key Benefits for Businesses and Customers

Virtual accounts deliver value across the collection chain.

For businesses:

100% automation: Eliminate Excel matching, AR aging issues, and DSO delays.

Scalability: Handle 10 or 10,000 customers with identical processes.

Cash flow insights: Know exactly who's paid, who's late, and collection trends.

For customers:

Simplicity: Pay via familiar UPI/net banking—no apps, cards, or QR codes needed.

Transparency: Clear invoice references reduce payment disputes.

Flexibility: Pay any amount, anytime without portal restrictions.

SprintNXT Virtual Accounts: Collections Made Smart

SprintNXT integrates virtual account IDs directly into its connected banking platform, combining collections with payouts and full reconciliation.

Key capabilities:

Bulk/static/dynamic IDs: Generate one-time or recurring virtual accounts via API.

Multi-bank support: Collections across partner banks routed to single dashboard.

UPI/IMPS/NEFT: All major rails supported with instant attribution.

Webhook integration: Real-time payment events to your CRM/ERP/billing system.

Analytics dashboard: Track collection efficiency, customer behavior, DSO trends.

Real-World Use Cases Across Industries

Virtual accounts power collections for diverse Indian businesses.

Marketplaces

Unique seller settlement IDs; auto-match COD/customer payments to orders.

SaaS/Subscriptions

Customer-specific IDs for renewals; auto-failover to collections/churn workflows.

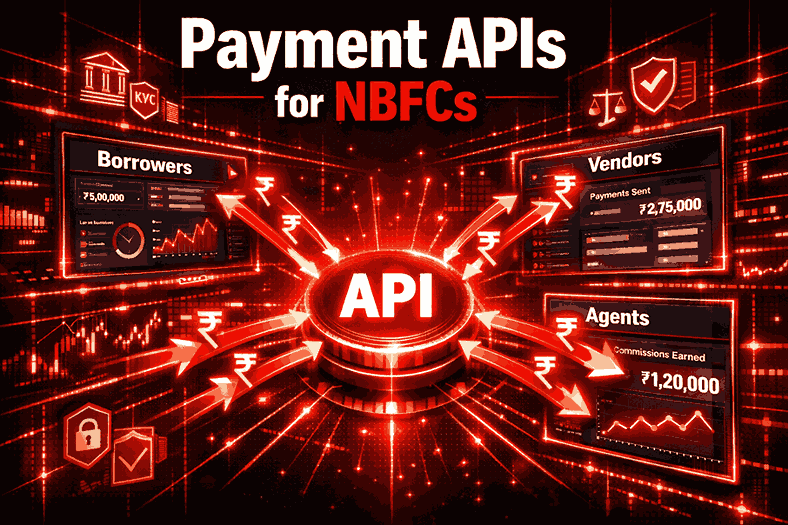

NBFCs/Lenders

Borrower IDs for EMI collections; instant status updates to loan management.

Edtech/Training

Course/batch-specific IDs; track fees by program/center/location.

B2B Invoicing

Per-invoice virtual accounts; auto-close AR once payment received.

Implementation Guide for Virtual Account Collections

Get started with virtual accounts in three phases.

Phase 1: Setup

Connect current accounts; generate test virtual IDs via SprintNXT dashboard/API.

Phase 2: Customer rollout

Assign IDs to top 20% customers by volume; add to invoices/statements.

Phase 3: Full automation

Integrate webhook to CRM/ERP; decommission manual reconciliation processes.

Pro tip: Start with dynamic IDs for one-off payments, static for recurring customers.

For onboarding assistance or architecture discussions, businesses can contact SprintNXT directly.

Conclusion

Virtual account IDs transform messy, manual collections into a clean, automated system where every payment arrives pre-tagged and reconciled. For Indian businesses scaling receivables, this isn't optional—it's infrastructure.

SprintNXT delivers enterprise-grade virtual accounts with UPI support, multi-bank flexibility, and deep API/webhook integration, making collections as simple as "generate ID, share link, receive tagged payment." The result: faster cash, zero reconciliation, and focus on growth rather than accounting.

Frequently Asked Questions

What exactly is a virtual account ID?

A unique identifier mapped to your main account that auto-tags incoming payments to specific customers/invoices.Do virtual accounts create separate bank accounts?

No—funds land in your master account; only tracking/attribution is virtual.Which payment methods work with virtual accounts?

UPI, IMPS, NEFT, RTGS—all major bank transfers in India.How does SprintNXT handle virtual account reconciliation?

100% automatic—payments auto-match to customers/invoices via webhook/API.Can customers pay via UPI to virtual IDs?

Yes, customers scan QR or enter VPA (yourbusiness@virtualaccount) like normal UPI.