Real-Time Cash Flow Analytics for Startups with SprintNXT

Startups live or die by cash flow, but traditional spreadsheets and monthly bank statements leave founders blind to real-time realities. Real-time analytics for startup cash flow pulls live data from bank accounts, payment gateways, and ERPs to show burn rate, runway, inflows/outflows, and liquidity gaps as they happen.

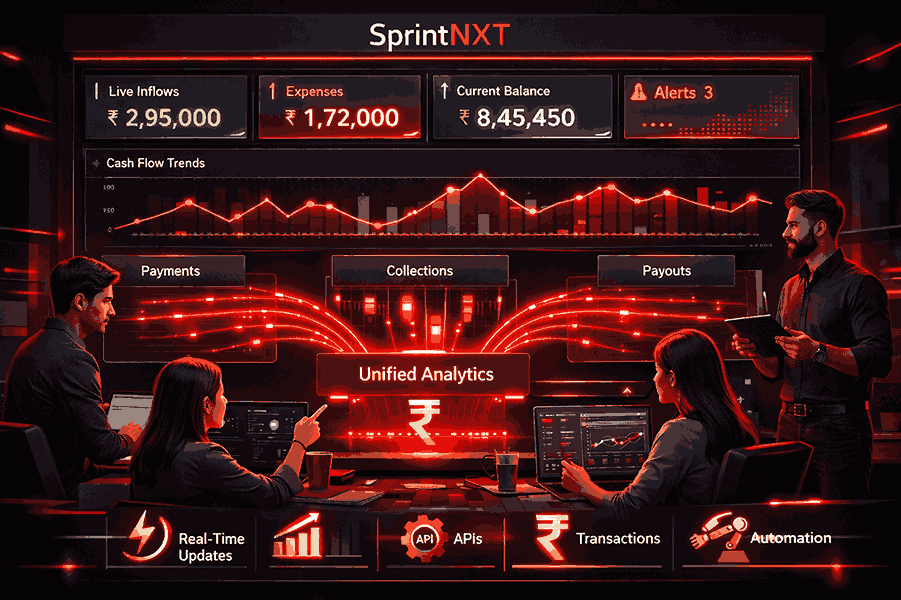

SprintNXT provides startups with a connected banking dashboard that aggregates transactions across current accounts, virtual collections, payouts, and reconciliations—delivering the real-time cash flow intelligence needed to make urgent decisions confidently.

This intelligence is powered by API-first banking infrastructure that continuously syncs live transaction data instead of relying on delayed statements.

Table of Contents

Why Startups Need Real-Time Cash Flow Analytics

What Real-Time Cash Flow Analytics Track

How SprintNXT Powers Startup Cash Flow Intelligence

Key Cash Flow Metrics for Startup Founders

Use Cases: Real-Time Insights in Action

Setting Up Real-Time Analytics in Minutes

Startup Success Stories with Cash Flow Analytics

Conclusion

Frequently Asked Questions

Why Startups Need Real-Time Cash Flow Analytics

98% of startups fail due to cash flow problems, not lack of product-market fit. Monthly forecasts miss:

Customer payment delays impacting runway

Unexpected vendor costs or churn

Payroll timing mismatches

Investor reporting deadlines

Real-time analytics solve this by:

Showing burn rate hour-by-hour, not month-by-month

Alerting on collection delays before they become crises

Optimizing payout timing across vendors/contractors

Providing investor-ready dashboards instantly

Real-time visibility becomes even more critical when collections rely on UPI-first payment flows with varying settlement timelines.

What Real-Time Cash Flow Analytics Track

Comprehensive startup cash flow monitoring covers:

Inbound (Collections):

UPI/virtual account payments by customer/invoice

Payment gateway settlements (T+0 vs T+1)

Subscription renewals and churn signals

AR aging and DSO trends

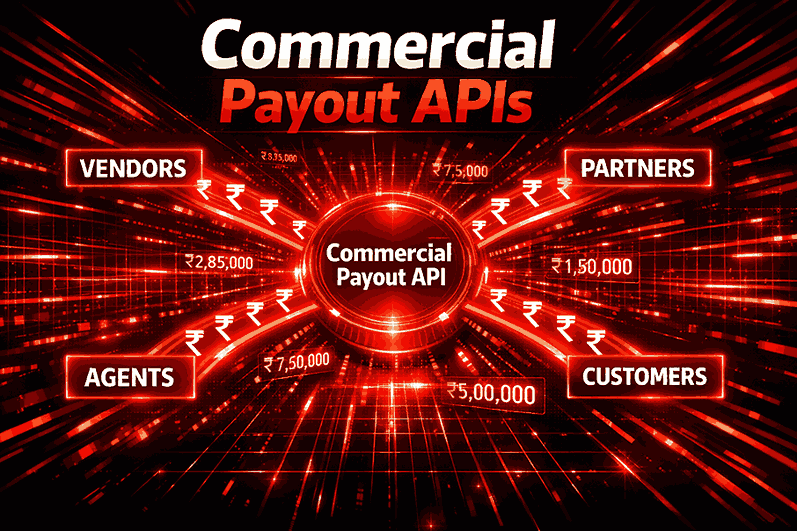

Outbound (Payouts):

Vendor payments, contractor settlements, refunds

Payroll run timing and tax outflows

Multi-bank payout costs and timing

Liquidity Signals:

7/30/90-day runway projections

Burn rate vs forecast variance

Idle cash optimization opportunities

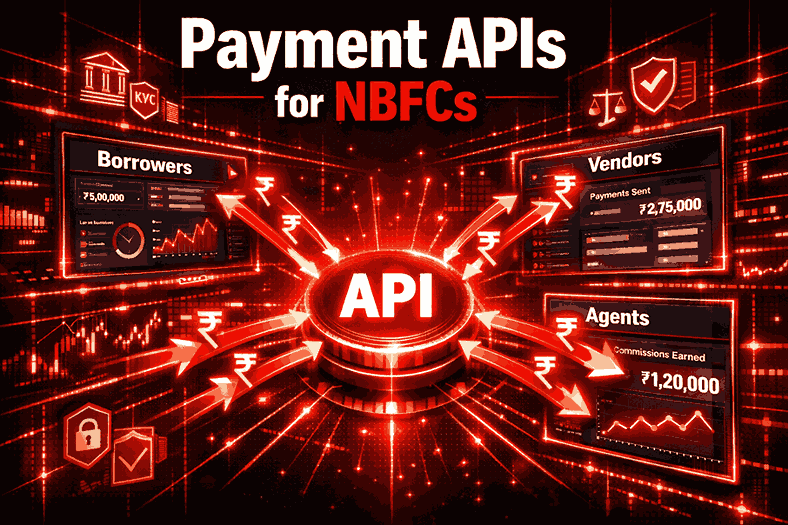

How SprintNXT Powers Startup Cash Flow Intelligence

SprintNXT transforms raw banking data into startup-ready analytics through:

Unified Data Layer:

Multiple Banks ? Single Dashboard ? Real-Time Insights

Current Accounts + Virtual IDs + PG Settlements

Live Metrics:

Cash Position: Available balance across all accounts

Net Burn: Daily outflow minus inflow

Runway: Days until cash hits critical threshold

DSO: Average days sales outstanding

Smart Alerts:

"Customer X overdue by 7 days (20% of monthly revenue)"

"Payroll outflow exceeds forecast by 15%"

"Gateway settlement delayed—impacts runway by 2 days"

Because SprintNXT also connects collections with automated payout systems, founders see the full cash lifecycle—not just inflows.

Key Cash Flow Metrics for Startup Founders

| Metric | Formula | Target | SprintNXT Shows |

| Runway | Cash ÷ Monthly Burn | >6 months | Real-time countdown |

| DSO | AR ÷ Daily Revenue | <30 days | Customer-level drill-down |

| Burn Rate | Total Outflows ÷ Days | Stable trend | Daily variance alerts |

| Collection Rate | Collected ÷ Billed | >95% | Gateway + VA breakdown |

Use Cases: Real-Time Insights in Action

SaaS Startup (50 customers):

Spots 3 major accounts delaying renewal payments

Triggers targeted collections via SprintNXT virtual accounts

Extends runway by 45 days?

E-commerce Marketplace:

Sees COD collections dropping 18% week-over-week

Identifies top 5 merchants causing delays

Adjusts settlement policies instantly

B2B Services Agency:

Payroll due Friday, cash shows 12% short

Delays 3 low-priority vendor payments by 48 hours

Avoids overdraft fees

Setting Up Real-Time Analytics in Minutes

3-Step Onboarding:

1. Connect bank accounts (2 mins)

2. Link payment gateways/virtual accounts (3 mins)

3. Cash flow dashboard live (instant)

No Data Entry Required: SprintNXT auto-pulls transactions via secure APIs—no CSV uploads, no manual categorization.

Custom Alerts: Set thresholds for runway, burn spikes, or collection delays with Slack/Whatsapp notifications.

Most startups complete onboarding using SprintNXT’s unified banking platform without changing their existing bank accounts.

Startup Success Stories with Cash Flow Analytics

SaaS at Scale: One SaaS startup cut DSO from 45 to 22 days using SprintNXT virtual accounts + real-time alerts, adding 3 months to runway.

Marketplace Survival: E-commerce platform spotted gateway settlement delays crushing margins; switched to SprintNXT Multi-PG, recovered 8% revenue.?

Agency Cash Flow: Creative agency avoided payroll crisis 3x by seeing vendor payment timing conflicts 48 hours early.

Conclusion

Real-time cash flow analytics aren't a "nice-to-have" for startups—they're survival infrastructure. When every day counts toward runway, founders need instant visibility into what's hitting the bank, what's delayed, and what's draining cash faster than planned.

SprintNXT delivers this through a unified dashboard connecting banks, gateways, virtual accounts, and payouts—giving startups the financial clarity enterprise tools provide, without enterprise complexity or pricing. Cash flow stops being a monthly mystery and becomes a daily advantage.

Frequently Asked Questions

What's real-time cash flow analytics?

Live monitoring of inflows/outflows with instant burn rate, runway, and liquidity insights across all bank accounts.How does SprintNXT calculate startup runway?

Pulls live balances + 30-day burn forecast from actual collections/payouts data.Do I need to categorize transactions manually?

No—SprintNXT auto-tags payments by customer/invoice via virtual accounts and gateways.What if I use multiple banks/payment gateways?

SprintNXT unifies them into single cash flow view with cross-account analytics.How accurate are the forecasts?

95%+ accuracy using actual transaction data vs historical spreadsheets.