How NBFCs Can Collect Smarter Using SprintNXT

Non-Banking Financial Companies (NBFCs) have witnessed a dramatic evolution in their collections landscape. Gone are the days when recovery meant countless phone calls, manual follow-ups, and spreadsheets that quickly became outdated. Today's NBFCs need intelligent, automated solutions that not only improve recovery rates but also enhance customer relationships while reducing operational costs.

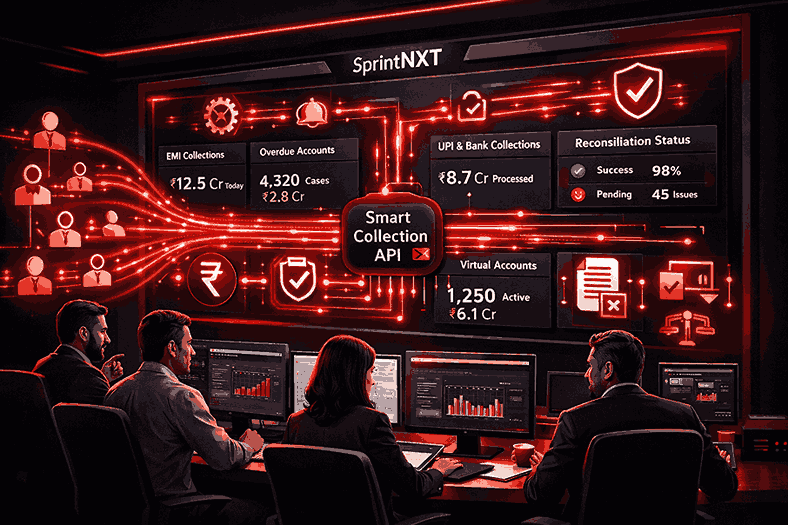

Enter SprintNXT—a comprehensive collections management platform designed specifically for the challenges modern NBFCs face. Here's how it's transforming the collections process from reactive chaos into proactive intelligence.

Table of Contents:

The Collections Challenge NBFCs Face Today

Smart Collections: What Does It Really Mean?

How SprintNXT Transforms Collections for NBFCs

Measurable Impact: The SprintNXT Difference

Getting Started with Smarter Collections

The Future of NBFC Collections

Conclusion

Frequently Asked Questions

The Collections Challenge NBFCs Face Today

Before we explore solutions, let's acknowledge the reality. NBFCs today juggle multiple pain points: rising delinquency rates, increasing portfolio sizes, regulatory compliance requirements, and the need to maintain positive customer experiences even during collections. Traditional methods simply can't scale to meet these demands while maintaining efficiency and compliance.

Manual processes lead to inconsistent follow-ups, missed opportunities for early intervention, and collection agents spending more time on administrative tasks than actual recovery work. The cost per recovery remains high, and portfolio visibility remains limited.

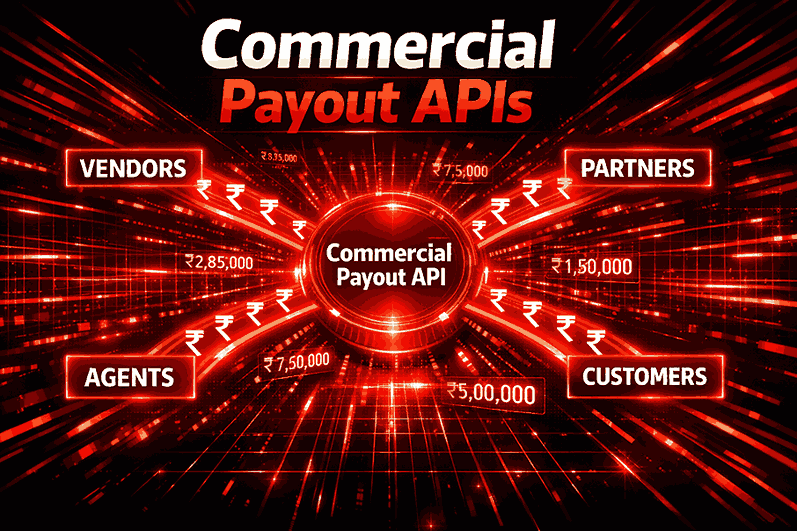

Learn more about: Commercial Payout APIs for NBFCs and Vendors with SprintNXT

Smart Collections: What Does It Really Mean?

Smart collections aren't just about automation—it's about intelligence. It means using data to predict which customers need attention, personalizing communication strategies based on customer behavior, automating routine tasks while keeping the human touch where it matters, and continuously optimizing strategies based on what's working.

SprintNXT brings this intelligence to every stage of the collections lifecycle.

How SprintNXT Transforms Collections for NBFCs

1. Predictive Analytics for Early Intervention

SprintNXT doesn't wait for accounts to become delinquent. Its predictive analytics engine analyzes payment patterns, customer behavior, and historical data to identify accounts at risk of default before they miss a payment. This early warning system allows NBFCs to take proactive measures—sending gentle reminders, offering payment plan adjustments, or reaching out with personalized support—before a small issue becomes a major problem.

2. Intelligent Customer Segmentation

Not all delinquent accounts are the same. Some customers genuinely forgot, others face temporary financial hardship, and some may be strategic defaulters. SprintNXT automatically segments customers based on payment history, communication responsiveness, financial capacity, and risk profile. This segmentation enables NBFCs to deploy the right collection strategy for each customer segment, dramatically improving recovery rates while reducing unnecessary aggressive tactics for customers who simply need a reminder.

3. Omnichannel Communication Orchestration

Today's customers interact across multiple channels—SMS, email, WhatsApp, phone calls, and app notifications. SprintNXT orchestrates communications across all these channels, ensuring customers receive consistent messaging through their preferred medium. The platform tracks which channels work best for which customer segments and automatically optimizes the communication mix. No more manual coordination across different systems or inconsistent messaging that confuses customers.

4. Automated Workflow Management

SprintNXT automates the entire collections workflow, from initial reminder generation to escalation protocols and legal notice preparation. Collection agents receive automated task lists prioritized by likelihood of recovery and account value. The system automatically escalates cases based on predefined rules, triggers follow-up actions when promises to pay aren't kept, and generates all necessary documentation for regulatory compliance.

This automation frees collection teams to focus on high-value activities—negotiating with difficult cases, building customer relationships, and developing recovery strategies—rather than drowning in administrative work.

5. AI-Powered Collection Strategies

SprintNXT's AI engine continuously learns from every interaction. It identifies which communication approaches work best for different customer types, determines optimal contact times for maximum responsiveness, suggests personalized payment plans based on customer capacity, and predicts the best settlement amounts for different accounts.

This machine learning capability means your collections strategy gets smarter every day, constantly improving based on real results rather than assumptions.

6. Real-Time Portfolio Visibility

With SprintNXT's comprehensive dashboard, collections managers get instant visibility into portfolio health, agent performance, recovery trends, and campaign effectiveness.

Real-time analytics replace end-of-month reports, allowing managers to identify problems and opportunities immediately and make data-driven decisions on resource allocation and strategy adjustments.

7. Compliance and Audit Trail

Regulatory compliance isn't optional. SprintNXT maintains complete audit trails of all communications and actions, ensures adherence to RBI guidelines and fair practice codes, automatically implements calling time restrictions and communication frequency limits, and generates compliance reports at the click of a button.

This built-in compliance framework protects NBFCs from regulatory risks while ensuring fair treatment of customers.

8. Integration with Existing Systems

SprintNXT doesn't operate in isolation. It seamlessly integrates with your existing loan management systems, payment gateways, core banking platforms, and CRM systems.

This integration eliminates duplicate data entry, ensures information consistency across systems, and provides a unified view of customer relationships.

Measurable Impact: The SprintNXT Difference

NBFCs implementing SprintNXT typically see significant improvements across key metrics. Recovery rates increase by 20-30% through early intervention and optimized strategies. Operational costs per recovery drop by 30-40% due to automation and efficiency gains. Customer satisfaction improves even during collections through personalized, respectful communication. Collection cycle times shorten as automated workflows eliminate delays and bottlenecks.

Getting Started with Smarter Collections

Implementing SprintNXT doesn't require a complete operational overhaul. The platform is designed for phased implementation, starting with core collections automation and gradually expanding to advanced analytics and AI-powered optimization. Most NBFCs see measurable improvements within the first 90 days.

The onboarding process includes data migration and system integration, training for the collection team on the new platform, customization of workflows to match your existing processes, and ongoing support and optimization.

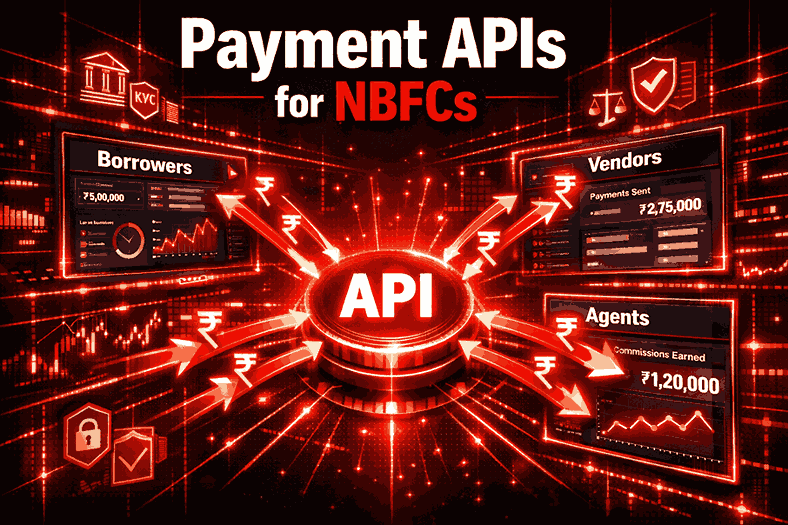

Also read: Payment API for NBFCs

The Future of NBFC Collections

The collections landscape will only become more complex. Customer expectations for digital, personalized experiences continue rising. Regulatory requirements grow more stringent. Portfolio sizes expand while margins tighten. In this environment, NBFCs that stick with manual, reactive collection approaches will find themselves at an increasing disadvantage.

SprintNXT represents the future of collections—intelligent, automated, customer-centric, and continuously improving. It transforms collections from a necessary evil into a strategic advantage, improving both recovery rates and customer relationships simultaneously.

Learn more about: Commercial Payout APIs for NBFCs and Vendors with SprintNXT

Conclusion

Smart collections aren't about working harder—it's about working smarter. SprintNXT gives NBFCs the tools to predict problems before they occur, communicate effectively across channels, automate routine tasks, optimize strategies based on data, maintain compliance effortlessly, and ultimately collect more while spending less.

In an industry where every percentage point of recovery matters and every rupee of operational cost counts, SprintNXT delivers measurable, sustainable improvements that directly impact the bottom line.

The question isn't whether to adopt smart collections technology—it's whether you can afford not to. Your competitors are already making the shift. Your customers expect better experiences. Your bottom line demands greater efficiency. It's time to collect smarter with SprintNXT.

Frequently Asked Questions

What is collections management software for NBFCs?

It's a digital platform that automates debt recovery using AI, analytics, and workflow automation to improve collection efficiency and reduce costs.

How can technology improve NBFC collection rates?

Technology can increase recovery rates by 15-20% and reduce operational costs by 25-30% through automation and predictive analytics.

What are the key features to look for in collections management software?

Look for smart workflows, predictive analytics, omnichannel communication, real-time reporting, compliance management, and core banking system integration.

How does collections software help with regulatory compliance?

It maintains complete audit trails, automatically implements RBI guidelines, enforces calling restrictions, and generates instant compliance reports.

Can collections software prevent loans from becoming NPAs?

Yes, predictive analytics identify at-risk accounts early, enabling proactive intervention before loans become non-performing assets.

What is the ROI of implementing collections management software?

NBFCs typically see 20-30% cost reduction and 25-35% increase in recovery rates within the first year of implementation.

How does omnichannel communication improve collections?

It reaches customers through their preferred channels (SMS, WhatsApp, email, phone), improving response rates and repayment convenience.

Can collections software work in areas with poor internet connectivity?

Yes, modern systems have offline modes that sync data automatically once connectivity is restored.

How long does it take to implement a collections management system?

Basic setup takes 1-2 weeks for cloud solutions, with full customization completed within 1-3 months.

What is the difference between manual collections and smart collections?

Manual collections use spreadsheets and reactive approaches, while smart collections leverage AI and automation for proactive, data-driven recovery strategies.