How SMEs Can Prevent Payment Delays and Improve Financial Discipline

Payment delays are one of the biggest challenges small and medium enterprises (SMEs) face in India. Late customer payments, inconsistent cash inflows, and manual financial processes often disrupt business operations and create financial stress. For many SMEs, delayed payments can limit growth, increase borrowing costs, and affect relationships with vendors and employees.

Preventing payment delays isn’t just about collecting money faster — it’s about building strong financial discipline across your entire business workflow. In this blog, we’ll explore practical strategies SMEs can use to prevent payment delays and maintain steady cash flow.

Table of Contents

Why Payment Delays Are a Major Issue for SMEs

Common Causes of Payment Delays

How SMEs Can Reduce and Prevent Payment Delays

Importance of Financial Discipline in Business

Digital Tools That Improve Payment Efficiency

Conclusion

Frequently Asked Questions (FAQs)

Why Payment Delays Are a Major Issue for SMEs

SMEs typically operate with limited cash reserves. When payments are delayed beyond their cycle — often 30, 45, or even 60 days — it becomes difficult to:

Pay employees on time

Manage inventory

Clear vendor dues

Fund daily operations

In India, nearly 65% of SMEs report experiencing frequent payment delays, which affects both their profitability and stability.

If your business relies on fast UPI or bank payment collections, this guide may be helpful.

Common Causes of Payment Delays

Payment delays usually happen due to:

1. Manual invoicing and follow-ups

Invoices sent late or reminders not scheduled.

2. Poor documentation

Missing details, incorrect amounts, or invoice errors.

3. Customer-side approval delays

Large organizations often follow multi-step approval processes.

4. Lack of payment options

Customers prefer fast, digital methods like UPI or online transfers.

5. Multiple bank accounts

Funds are scattered across banks with no unified visibility.

6. No automated reminders

Without reminders, outstanding payments are often forgotten.

Understanding these issues helps SMEs build strong payment systems.

How SMEs Can Reduce and Prevent Payment Delays

Here are actionable strategies to get paid faster and maintain steady cash flow:

1. Send invoices immediately

Late invoicing = late payments. Use digital tools to create and send invoices instantly.

2. Offer multiple payment methods

UPI, QR codes, bank transfers, and online payment links help customers pay faster.

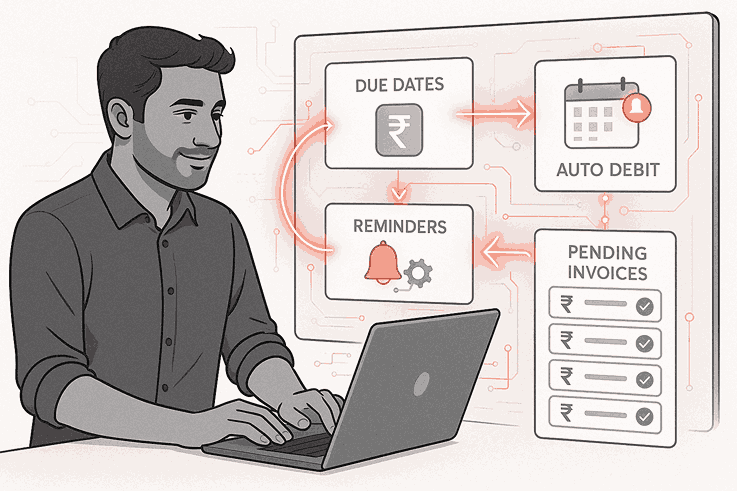

3. Automate payment reminders

Automated SMS/email reminders reduce follow-up effort and increase on-time payments.

4. Set clear payment terms

Communicate due dates, penalties, and expectations before starting work.

5. Incentivize early payments

Offer small discounts to encourage customers to pay early.

6. Use digital contracts to avoid disputes

Well-drafted digital agreements reduce confusion around deliverables and payments.

7. Track receivables regularly

Weekly monitoring helps identify overdue invoices faster.

8. Use business banking platforms for collections

Platforms like SprintNXT help SMEs automate collections via:

UPI-based customer payments

Dynamic/static QR codes

Virtual payment IDs

Automated reconciliation

This reduces delays caused by manual tracking.

Learn more about how virtual account automation improves reconciliation

Importance of Financial Discipline in Business

Financial discipline ensures that SMEs maintain stability even when facing uncertainties. It includes:

Keeping proper financial records

Tracking cash flow regularly

Setting budgets and controlling expenses

Making timely payouts

Ensuring compliance with accounting standards

SMEs with strong financial discipline not only avoid cash flow issues but also become more credible in the eyes of investors, lenders, and customers.

If you want to streamline payouts, this can help.

Digital Tools That Improve Payment Efficiency

Modern financial tools make it easier for SMEs to get paid on time.

Platforms like SprintNXT offer:

Automated collection systems

Real-time tracking of payments

Multi-bank account management

Automated reconciliation

Payment analytics

Bulk payouts to vendors and employees

Digital solutions help SMEs build predictable payment cycles and reduce dependency on manual follow-ups.

Conclusion

Payment delays can significantly impact the financial health of SMEs. By improving invoicing processes, offering multiple payment options, automating reminders, and using digital tools, businesses can create a system that ensures faster collections and stronger financial discipline.

With unified business banking platforms like SprintNXT, SMEs can streamline collections, monitor cash flow, and improve financial planning — helping them run their business smoothly and confidently.

Frequently Asked Questions (FAQs)

Why do SMEs face payment delays?

Because of manual invoicing, approval delays, lack of reminders, and limited payment options.

How can SMEs reduce late payments?

By sending invoices on time, automating reminders, and offering UPI/digital payment options.

What is financial discipline for SMEs?

Maintaining control over cash flow, expenses, and financial processes.

Can digital tools help improve payment cycles?

Yes — platforms like SprintNXT automate collections and reduce delays.

Why is it important to monitor receivables?

Tracking receivables helps SMEs identify overdue invoices and take action early.