What Is Cash Flow Management? A Simple Guide for Small Businesses

Cash flow management is the heartbeat of every business. For small and medium enterprises (SMEs), maintaining a steady flow of money coming in and going out is essential for survival and growth. Yet, many SMEs struggle with managing their finances due to delayed payments, manual processes, and poor financial visibility.

Effective cash flow management helps businesses stay stable, pay their bills on time, and plan for future growth — even during uncertain economic conditions.

To understand how digital tools can streamline business finance, you can explore the SprintNXT unified business banking platform

In this blog, we’ll simplify everything you need to know about cash flow management, why it matters for SMEs, and how modern digital tools like unified banking platforms are helping businesses stay financially healthy.

Table of Contents

What Is Cash Flow Management?

Why Cash Flow Management Matters for SMEs

Types of Cash Flow Every Business Should Know

Common Cash Flow Challenges for SMEs

Best Practices for Effective Cash Flow Management

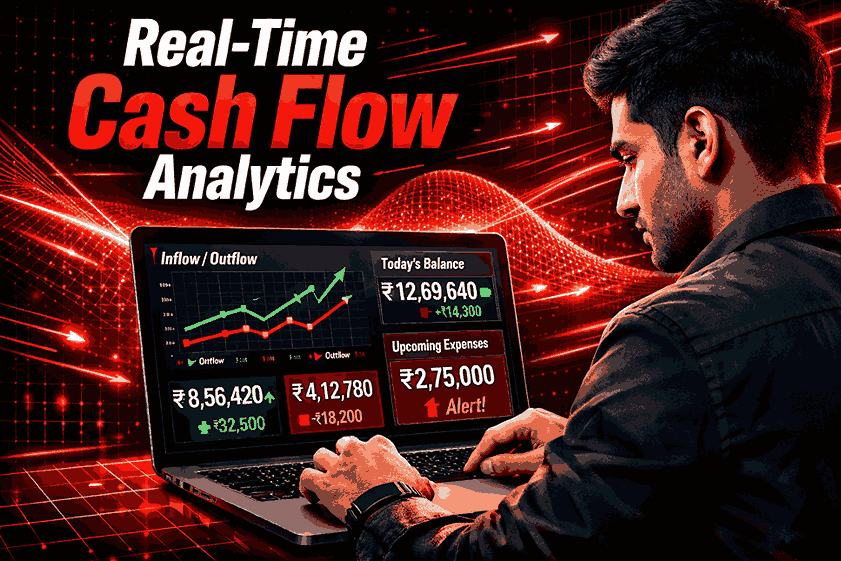

How Digital Tools Improve Cash Flow Visibility

Conclusion

Frequently Asked Questions (FAQs)

What Is Cash Flow Management?

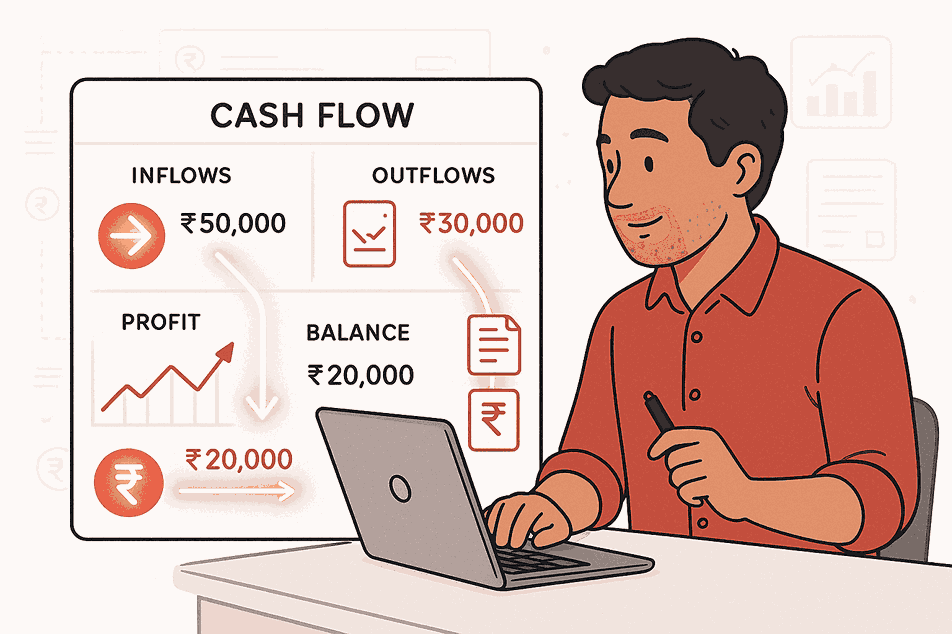

Cash flow management refers to tracking, analyzing, and optimizing the way money enters and leaves your business.

It ensures that you have enough cash available to meet daily needs like:

Paying employees

Buying inventory

Settling vendor payments

Managing rent, utilities, and operational expenses

Effective cash flow management helps SMEs maintain financial stability and avoid liquidity issues.

If your business relies on UPI payments or online transfers, this guide is helpful

UPI payments or online transfers

Why Cash Flow Management Matters for SMEs

SMEs operate with smaller margins and limited capital reserves. Cash shortages — even short-term — can disrupt operations.

Good cash flow management helps SMEs:

Avoid late payments and penalties

Improve vendor and employee relationships

Predict financial needs and plan ahead

Maintain business continuity

Make better decisions with real-time financial data

In India, where payment cycles often stretch beyond 30–45 days, SMEs especially need structured cash flow practices.

For vendors and employee payments, automated payout workflows can help

Types of Cash Flow Every Business Should Know

Understanding your cash flow helps you manage your finances more effectively. The three major types are:

1. Operating Cash Flow

Money generated from everyday business activities — sales, services, collections.

2. Investing Cash Flow

Cash used for buying assets, equipment, or investment activities.

3. Financing Cash Flow

Money from loans, investor funding, or repayment of borrowings.

SMEs should monitor all three to maintain a stable financial position.

4. Common Cash Flow Challenges for SMEs

Small businesses often struggle because of:

Delayed customer payments

High operational expenses

Manual invoicing and reconciliation

Multiple bank accounts with no unified visibility

Unpredictable sales cycles

Difficulty securing working capital loans

These issues can cause SMEs to face cash shortages, even when business is profitable.

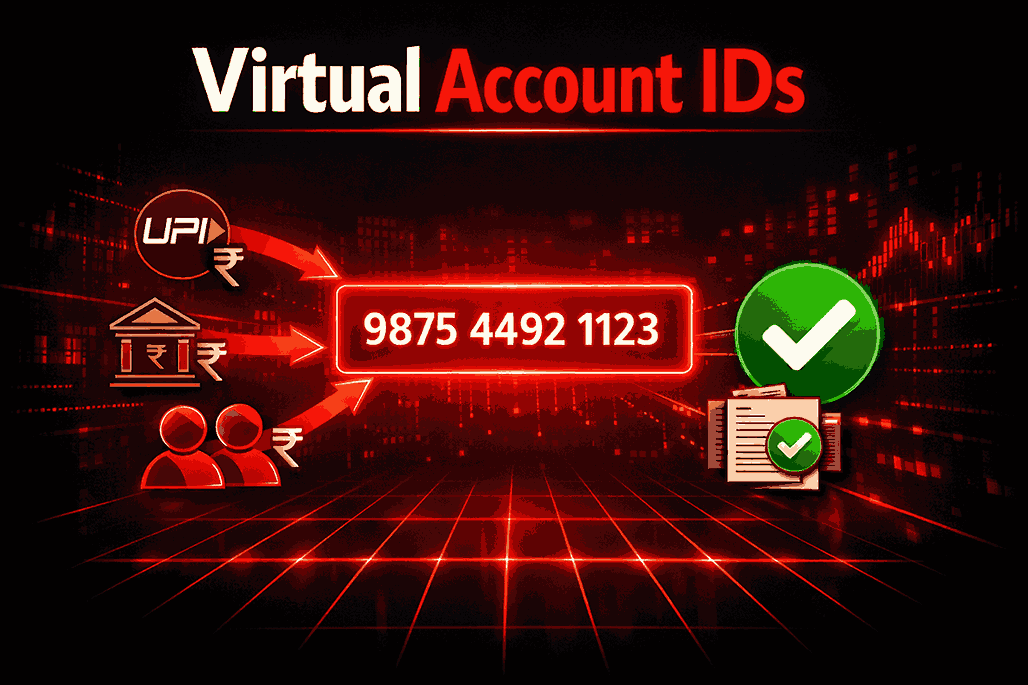

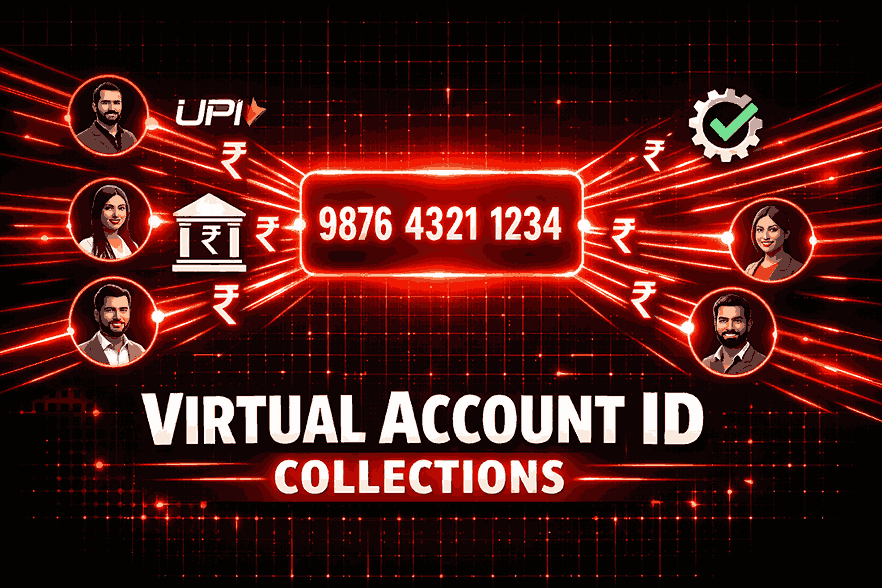

Explore how virtual accounts solve reconciliation and visibility issues.

Best Practices for Effective Cash Flow Management

SMEs can strengthen their financial position by adopting simple, structured practices:

1. Use digital invoices and automated reminders

Reduces delays and encourages timely payments.

2. Monitor expenses closely

Identify unnecessary costs and negotiate with vendors.

3. Maintain a cash reserve

Helps manage unforeseen expenses.

4. Automate collections and payouts

Improves efficiency and reduces manual errors.

Learn more about automated payout workflows

5. Track cash flow daily or weekly

Provides visibility into financial health.

6. Use tools for multi-bank account management

Platforms like SprintNXT let SMEs view balances, transactions, and payouts from one dashboard.

How Digital Tools Improve Cash Flow Visibility

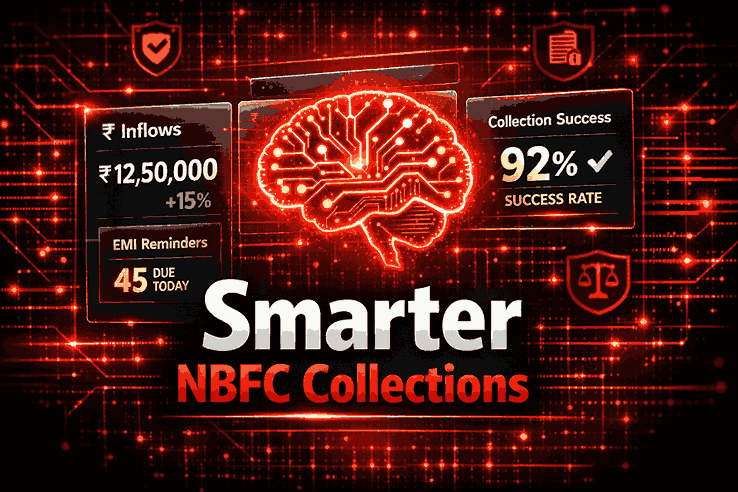

Modern business banking platforms play a crucial role in solving cash flow problems for SMEs.

Solutions like SprintNXT offer:

Real-time cash flow insights

Automated reconciliations

UPI-based collections

Bulk payouts to vendors and employees

Multi-bank account management

Smart analytics to predict financial needs

These tools reduce manual effort and help SMEs understand their finances more accurately.

Conclusion

Cash flow management is one of the most important aspects of running a business — especially for SMEs. With the right strategies and digital tools, businesses can maintain healthy cash flow, reduce financial stress, and prepare for sustainable growth.

By adopting unified business banking platforms and automating financial operations, SMEs can gain better visibility, improve efficiency, and stay ahead in today’s fast-paced business environment.

Frequently Asked Questions (FAQs)

What is the meaning of cash flow in business?

Cash flow refers to the movement of money into and out of your business from operations, investments, and financing activities.

Why is cash flow management important?

It helps businesses pay bills on time, maintain stability, and plan future growth.

What causes cash flow problems?

Delayed payments, high expenses, manual financial processes, and poor planning.

How can SMEs improve cash flow?

By automating collections, reducing expenses, tracking finances regularly, and using tools like SprintNXT for real-time visibility.

Can digital platforms help with cash flow management?

Yes. Unified business banking platforms help automate payments, manage collections, and provide real-time financial data.