Understanding Virtual Accounts: How Businesses Use Them for Collections

Virtual Accounts are becoming increasingly popular as digital payments continue to grow in India. Businesses today are adopting smarter ways to collect and track payments, and virtual accounts have emerged as one of the most effective innovations. They help streamline collections, simplify reconciliation, and provide better visibility into incoming funds — especially for SMEs, fintechs, and large enterprises managing high transaction volumes.

To explore how businesses manage automated collections using unified systems, you can check SprintNXT’s platform.

In this blog, we’ll break down what virtual accounts are, how they work, and why modern businesses rely on them to manage collections more efficiently.

Table of Contents

What Are Virtual Accounts?

How Virtual Accounts Work

Types of Virtual Accounts

Why Businesses Use Virtual Accounts for Collections

Key Benefits for SMEs and Enterprises

How Digital Platforms Simplify Setup and Management

Conclusion

Frequently Asked Questions (FAQs)

What Are Virtual Accounts?

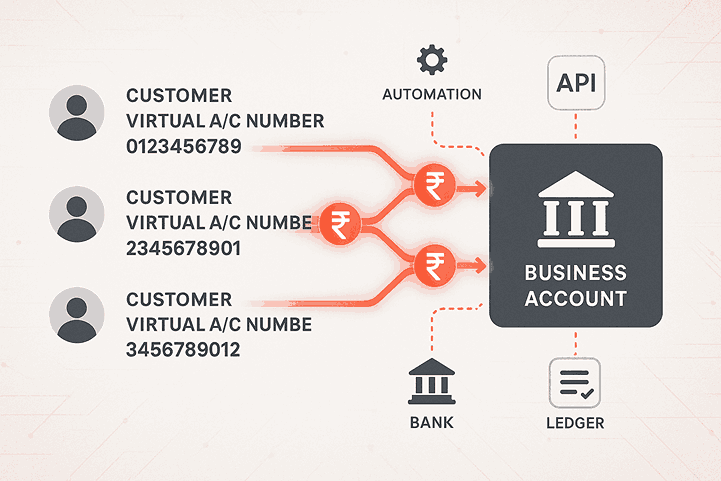

A virtual account is a unique, digital account number assigned to each customer, transaction, or payment source to help businesses track collections easily.

Unlike regular bank accounts, virtual accounts do not hold funds. All payments made to a virtual account are instantly redirected to the business’s main bank account — but with complete traceability.

In simple terms:

Virtual accounts act like unique payment identifiers that allow businesses to know exactly who paid, when, and for what — without manual tracking.

If your business receives payments via UPI, NEFT, or online channels, explore how UPI collection flows work.

How Virtual Accounts Work

Here’s how virtual accounts simplify collections:

The business generates a unique virtual account for each customer or transaction.

The customer makes a payment using UPI, NEFT, RTGS, IMPS, or bank transfer.

The payment is routed to the business’s main account.

The system automatically identifies the payer using the virtual account mapping.

The transaction is matched and reconciled instantly.

This eliminates guesswork, email follow-ups, and manual reconciliation.

To understand the API-based automation behind these flows, check

API-based automation

Types of Virtual Accounts

Businesses can use different types of virtual accounts based on their needs:

1. Customer-Level Virtual Accounts

Each customer gets a unique virtual account for all payments.

2. Invoice-Level Virtual Accounts

Each invoice gets its own virtual account, helping track specific transactions.

3. Transaction-Level Virtual Accounts

Best for high-volume businesses needing robust tracking and automation.

4. UPI Virtual Payment Addresses (VPAs)

Virtual UPI IDs used to collect payments easily and instantly.

Why Businesses Use Virtual Accounts for Collections

Traditional collection methods — like sharing a single bank account number — create challenges:

Difficult to identify who paid

Manual reconciliation required

Payment delays due to incorrect references

Errors in matching transactions

Limited visibility across multiple channels

Virtual accounts solve these issues by ensuring every payment is uniquely identifiable.

Key Benefits for SMEs and Enterprises

Virtual accounts offer significant advantages for businesses of all sizes:

1. Automated Reconciliation

Every payment gets matched automatically, reducing manual work.

For an in-depth view of reconciliation automation benefits, check

reconciliation automation benefits

2. Faster Collections & Cash Flow

Customers can pay directly using UPI or bank transfer — no delays.

3. Error-Free Tracking

Unique virtual accounts eliminate reference mismatches.

4. Better Customer Experience

Customers don’t need to add complex account details — payments are frictionless.

5. Multi-Bank Visibility

Businesses see all collections in real time across all banks.

6. Scalable for High Transactions

Ideal for NBFCs, edtechs, marketplaces, and D2C brands.

How Digital Platforms Simplify Setup and Management

Unified business banking platforms like SprintNXT allow businesses to:

Generate virtual accounts on-demand

Assign them to customers, invoices, or transactions

Receive payments via UPI, NEFT, RTGS, IMPS

Automate reconciliation

View collections in one dashboard

Track real-time cash flow

Integrate via APIs for end-to-end automation

By replacing manual processes with virtual accounts, SMEs and enterprises can improve payment efficiency, reduce errors, and ensure smooth financial operations.

Conclusion

Virtual accounts are transforming how Indian businesses collect payments. They offer speed, accuracy, automation, and complete visibility — making them essential for SMEs looking to improve cash flow and reduce manual workload.

With platforms like SprintNXT, businesses can easily generate virtual accounts, automate collections, and manage multiple payment streams from a single dashboard. This simplifies financial operations and helps companies scale with confidence.

Frequently Asked Questions (FAQs)

What is a virtual account in banking?

A virtual account is a unique digital account number used to track collections for customers, transactions, or invoices.

Do virtual accounts hold money?

No. Payments made to a virtual account are redirected to the business’s main bank account.

Can customers pay using UPI?

Yes. Virtual accounts support UPI, NEFT, RTGS, IMPS, and online transfers.

Are virtual accounts useful for SMEs?

Absolutely — they simplify reconciliation, improve tracking, and reduce manual work.