How to Resolve Failed UPI Transactions and Handle Refunds on Business Platforms

UPI has fundamentally changed digital payments for businesses in India, enabling near-instant settlements and streamlining every aspect of business cash flow. But with heavy volumes and fluctuating network conditions, even the most resilient UPI platforms experience occasional failures. When payments fail or funds are deducted but not credited, quick resolution and transparent refund handling are essential for maintaining customer trust and efficient operations. Here’s a structured guide that

explains exactly why UPI transactions sometimes

fail, how refunds work, and what processes and tools business platforms should

follow to resolve them.

Table of Contents

1.

Common

Causes of Failed UPI Transactions

2.

Step-by-Step

Process to Resolve Failed UPI Payments

3.

How

UPI Refunds Work for Failed Transactions

4.

Best

Practices for Minimizing Failures

5.

Common

Challenges Businesses Face

6.

Future

Trends for UPI Refunds and Dispute Resolution

7.

FAQs

About UPI Failures and Refunds

Common Causes of Failed UPI Transactions

Failed UPI payments can result from a variety of routine and technical issues. The most frequent reasons include insufficient funds in the payer’s bank account, incorrect UPI PIN entries, or outdated apps. Other causes might be incorrect UPI IDs or recipient account details provided by users, bank or PSP server downtime, reaching daily/per-transaction limits, or suspicious activity triggering a security freeze. In periods of network congestion or high server load, even normally reliable payments can be delayed or fail temporarily.

For enterprises handling large volumes of transfers, solutions like a Bulk Payment API can help reduce errors, improve efficiency, and ensure smoother transaction management.

Step-by-Step Process to Resolve Failed UPI Payments

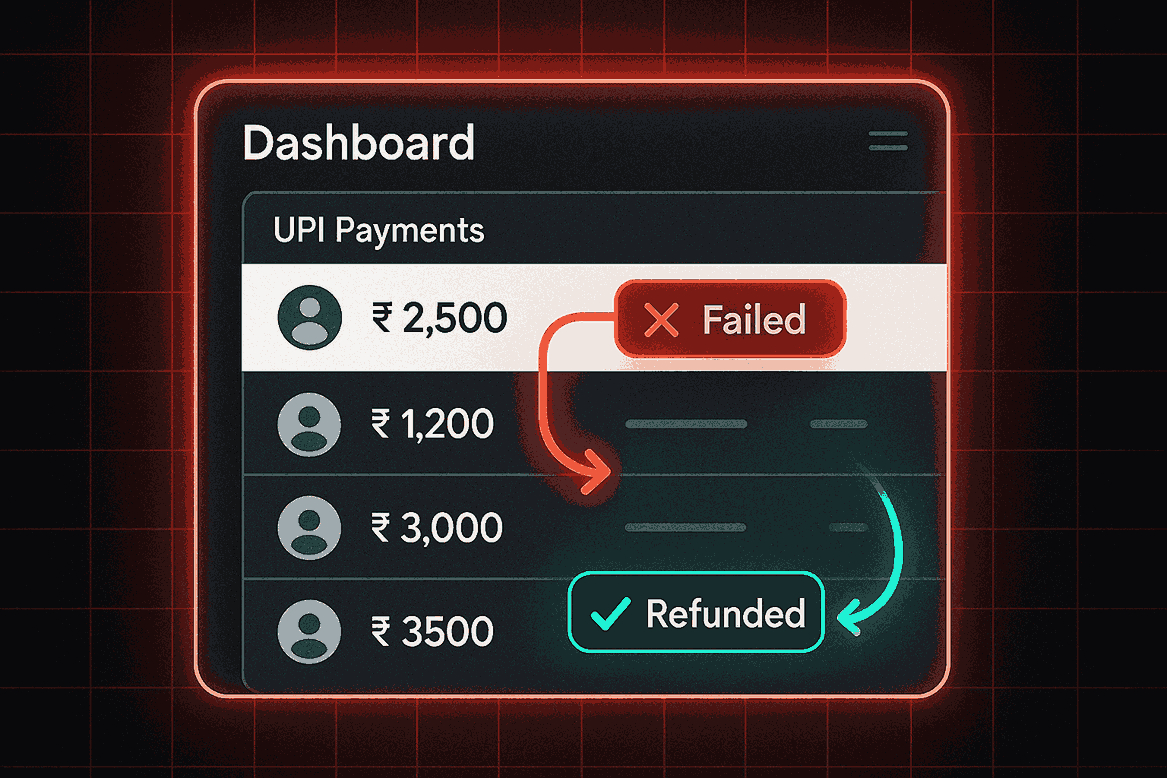

To resolve a

failed UPI payment, start by checking the transaction status within your

business platform dashboard or end-customer app. Often, issues resolve on their

own as banking systems reconcile entries in the background—usually within a few

minutes to a business day.

If it’s

still unresolved:

1.

Confirm

that account balances, UPI PINs, and details are correct.

2.

Retry

the transaction after ensuring a stable internet connection and an updated app.

3.

If

failure persists, use the “Help” or “Support” feature in your UPI-enabled

business app to generate a ticket.

4.

Contact

your business banking partner’s support team with the transaction ID, date, and

amount.

5.

As

a last step, escalate persistent issues via NPCI’s UPI dispute mechanism using

the bank reference number and evidence.

How UPI Refunds Work for Failed Transactions

When a UPI

payment fails, most platforms and banks automatically reverse the funds to the

sender’s account, creating a “UPI-REV” or “RET” entry in the transaction

statement. The process usually completes within 1–3 business days under RBI and

NPCI guidelines; however, refunds for unusual or disputed cases may take

slightly longer.

Track all refund statuses using your UPI app’s transaction history. If money isn’t returned automatically, raise a complaint via your app or dashboard, and escalate to the PSP or bank if resolution is delayed. In cases of wrong transfers, business users may need to contact both banks and provide documentation for reversal, spanning up to 7 working days for complex cases. Fraud or unauthorized transactions may require formal NPCI involvement.

For businesses looking to streamline refunds and payment collections, explore our guide on the complete UPI Collection API.

Best Practices for Minimizing Failures

For business

platforms, prevention is key. Always keep your UPI apps and APIs updated, and

educate team members to double-check transaction details before making payouts.

Use real-time reconciliation tools and dashboard alerts to track failed or

duplicate payments immediately. Plan fallback options such as IMPS or NEFT for

critical payouts during rare UPI downtime windows, and automate notifications

for both staff and end-customers when payment or refund status changes.

Common Challenges Businesses Face

Handling

large volumes of payouts or bulk refunds brings unique operational challenges.

Delayed refunds can frustrate users and burden support teams. Businesses may

struggle with cross-bank disputes, especially where multiple intermediaries are

involved, or with keeping all transactions traceable at scale. Integration of

refund status dashboards and clear customer communication workflows is

essential to reduce friction and maintain reliability.

Future Trends for UPI Refunds and Dispute Resolution

As UPI evolves, businesses can expect even faster automatic reversals and real-time status dashboards for monitoring refunds. AI-powered chargeback risk detection, proactive dispute alerts, and bulk refund automation APIs will streamline business operations while minimizing friction, fraud, and customer complaints.

As UPI refunds and dispute resolution evolve, integrating robust fraud prevention measures becomes essential—read our detailed article to learn how SMEs can minimize risks and protect their payments.

FAQs About UPI Failures and Refunds

What should a business do if a UPI transaction fails but money is debited?

Wait at

least 24–48 hours for an auto-refund. If the money is not credited, raise a

complaint in your UPI business dashboard and contact your business bank with

the full transaction details.

How long do UPI refunds take?

Most

auto-refunds arrive within 1–3 business days, depending on the bank and

platform.

Can business platforms automate UPI refund dashboards?

Yes! Many

platforms and APIs now allow status tracking and reconciliation for failed

payments and refunds, reducing manual checks.

What if the wrong UPI ID is entered?

Try

contacting the unintended recipient for a reversal. If unsuccessful,

immediately contact your bank and file a dispute; this may require NPCI

escalation and verification documents.

Are UPI refunds secure and reliable?

UPI refunds

must follow India’s strong regulatory (RBI/NPCI) and technical standards, with

encryption and authentication to protect user funds.

How do large businesses handle refunds at scale?

By using

automated refund APIs, daily monitoring dashboards, and integrating

notification systems to keep customers informed about payout status and

resolution timelines.