How Do API Integrations Work? Making Sense of Embedded Finance for SMEs

Embedded

finance is transforming the way small and medium-sized enterprises (SMEs)

manage everything from payments to credit and insurance. By integrating

financial services directly into business platforms and digital tools using

APIs, SMEs can offer seamless financial experiences to customers, automate

back-office operations, and access new revenue streams—all without becoming

banks themselves. But how do these API integrations work in practice, and what

steps can an SME follow to safely and successfully adopt embedded finance? In

this blog, we break down everything you need to know to make sense of the API

revolution.

Table of Contents

1.

What

Is an API and Embedded Finance?

2.

Why

Embedded Finance Matters for SMEs

3.

How

API Integrations Actually Work

4.

Step-by-Step:

Implementing APIs for Embedded Finance

5.

Key

Benefits for SMEs

6.

Best

Practices and Tips

7.

Common

Challenges and How to Overcome Them

8.

Future

Trends in Embedded Finance

9.

FAQs

on Embedded Finance and API Integrations

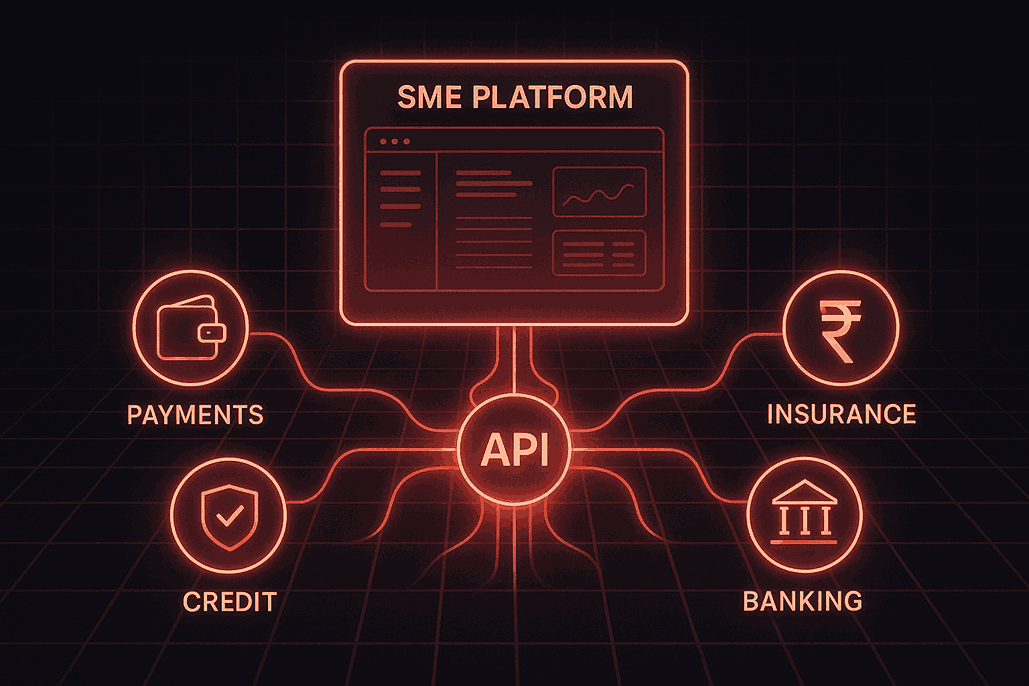

What Is an API and Embedded Finance?

An API (Application Programming Interface) is a digital bridge that lets different software systems talk to one another and exchange information securely. In the context of finance, APIs allow business software—such as e-commerce platforms, accounting suites, or payroll systems—to connect directly with banks, lenders, payment gateways, and fintechs. Embedded finance, meanwhile, refers to the integration of these financial services into non-financial platforms via APIs. This enables SMEs to offer payment processing, loans, insurance, and more, directly inside the software their teams and customers already use.

For a deeper look into real-world applications, check out our article on SprintNXT’s banking API solutions, designed to help businesses integrate secure and scalable financial services.

Why Embedded Finance Matters for SMEs

For SMEs,

embedded finance isn’t just about convenience—it’s about unlocking entirely new

business models and efficiencies. Digital-first businesses can enable instant

customer checkouts, provide vendor loans at the point of invoice, or automate

employee payments, all within their existing workflow. This integration

improves user experience, speeds up cash flow, and helps small businesses

compete with larger, more established rivals. Most importantly, it means SMEs

can focus on their core operations while relying on secure, regulated partners

to handle the technical and compliance complexities of financial services.

How API Integrations Actually Work

Behind every

embedded finance solution is a series of API connections. When an SME wants to

accept payments or offer financial services, the business platform sends

encrypted data requests through the API to the financial partner. The partner’s

server processes the request—such as a payment or loan—and sends back the

results in real-time. APIs ensure that transactions are seamless, secure, and

fast. With modular API design, SMEs can add or swap different financial

services (like switching between payment gateways) without rebuilding their

entire system.

Step-by-Step: Implementing APIs for Embedded Finance

1.

Define Your Use Case:

Decide what financial services to embed—payments, lending, insurance, or

others.

2.

Choose the Right API Provider:

Evaluate security, compliance, track record, and industry fit for your partner.

3.

Check Technical Requirements:

Review authentication methods (e.g., OAuth, API keys), available SDKs, and

developer documentation.

4.

Test in a Sandbox:

Use your provider’s sandbox to simulate real transactions and catch issues

before going live.

5.

Go Live and Monitor:

Launch your integration, track performance, and use analytics to ensure

everything runs smoothly; optimize as your business grows.

Key Benefits for SMEs

API

integrations and embedded finance offer SMEs multiple advantages:

- Time and Cost Savings: Automate manual processes and

eliminate paperwork.

- Faster Settlements: Enable instant transactions

versus batch/bulk banking.

- Customer Experience: Provide smooth, in-app

payments, financing, or loyalty solutions.

- New Revenue Streams: Earn fees or commissions from

embedded financial products.

- Scalability: Easily add or update financial integrations as your business changes.

For SMEs aiming to maximize efficiency and customer experience, our detailed guide on the top 10 payment solutions for SMEs in Delhi, Mumbai, and Bangalore highlights the best platforms to integrate.

Best Practices and Tips

- Prioritize security and

compliance (look for PCI DSS, GDPR, and local regulators’ seals).

- Choose APIs with detailed docs,

SDKs, and sample code for developers.

- Monitor real-time logs and have

a process for quick troubleshooting.

- Partner with providers offering

ongoing support and clearly defined SLAs.

- Focus on modular architecture so

future integrations and upgrades are easier.

Common Challenges and How to Overcome Them

Many SMEs

worry about the complexity of integrating APIs or navigating compliance

requirements. Legacy software might not support modern APIs, meaning upgrades

or middleware could be required. Training your team and ensuring your

developers understand the API documentation and payloads is also key. The most

successful SME integrations start small—testing one use case—before expanding

to more embedded financial features as confidence grows.

Future Trends in Embedded Finance

As the industry evolves, expect to see more AI-powered APIs that detect fraud, automate compliance, and offer personalized financial products in real time. Blockchain-based APIs will make cross-border payments and settlements even faster and cheaper. And as more trusted API providers enter the market, SMEs will gain access to a wider ecosystem of embedded financial partners, leveling the playing field with large enterprises.

Among the most impactful innovations, the Bulk Payment API is revolutionizing enterprise transactions by enabling faster, more efficient, and scalable payouts.

FAQs on Embedded Finance and API Integrations

What is embedded finance for SMEs?

It’s the

seamless integration of financial products—like payments, lending, or

insurance—into non-banking business platforms, powered by secure APIs.

Are API integrations secure for small businesses?

Yes, if you

use regulated providers and proven security features like encryption, strong

authentication, and regular audits.

How long does API integration take for an SME?

With modern,

well-documented APIs and SDKs, integration can often be done in days or weeks,

depending on complexity.

What are some good use cases for embedded finance?

Instant

checkout, in-app lending, automatic payroll, vendor financing, and unified

rewards programs are common examples for SMEs.

Will APIs replace traditional banking for SMEs?

Not entirely. APIs let SMEs “plug in” best-in-class banking features without needing a banking license. But traditional banks and fintech APIs are increasingly blending their roles.