Why Reconciliation Errors Happen & How Businesses Can Avoid Them

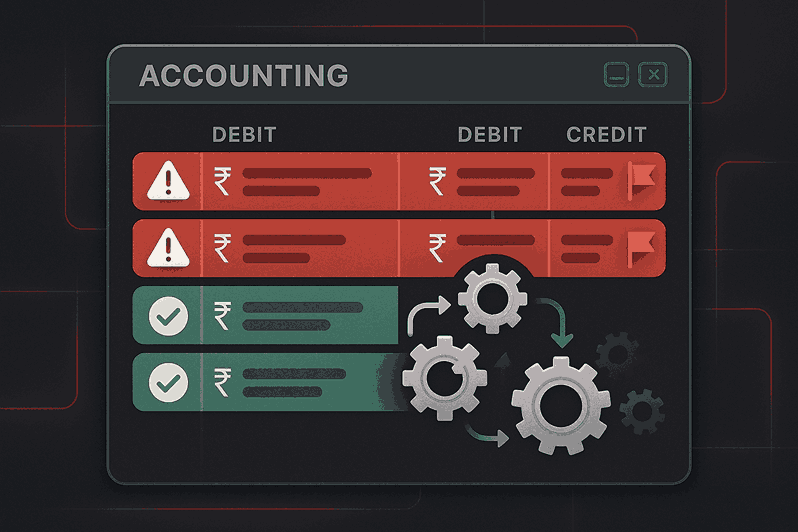

Payment Reconciliation is one of the most important financial processes for any business, but also one of the most time-consuming and error-prone. Whether you run a small business or manage a large enterprise, manually matching payments with invoices can lead to delays, inaccuracies, and even financial losses.

With digital payments growing rapidly in India, SMEs often handle hundreds or thousands of transactions every month. Without the right systems in place, reconciliation errors can easily slip through the cracks.

To learn how modern unified platforms streamline business finance, explore SprintNXT

In this blog, we’ll break down why reconciliation errors happen, their impact on businesses, and how modern digital tools can eliminate them entirely.

Table of Contents

What Is Payment Reconciliation?

Why Reconciliation Errors Happen

Common Types of Reconciliation Errors

Impact of Reconciliation Errors on Businesses

How to Prevent Reconciliation Errors

How Digital Platforms Automate Reconciliation

Conclusion

Frequently Asked Questions (FAQs)

What Is Payment Reconciliation?

Payment reconciliation is the process of matching payments received with the correct:

Invoice

Customer

Transaction ID

Bank entry

Accounting record

The goal is to ensure accuracy between bank transactions and internal financial records.

Without proper reconciliation, businesses may lose track of revenue, miscalculate financial performance, or experience operational delays.

If your business handles large volumes of UPI payments or online collections, this guide may help

Why Reconciliation Errors Happen

Reconciliation errors are common, especially among SMEs relying on outdated or manual methods. Errors typically occur due to:

1. Manual Data Entry

Human errors while entering invoice numbers or amounts.

2. Multiple Payment Channels

UPI, NEFT, IMPS, cash, cheques — multiple sources create confusion.

3. Missing Payment References

Customers often forget to add invoice numbers when transferring money.

4. Duplicate Transactions

Multiple payments for the same invoice or accidental repeats.

5. Multiple Bank Accounts

Funds spread across accounts with no unified view.

6. System Delays or Failures

Late settlement updates can cause mismatches.

These issues make traditional reconciliation slow and error-prone.

To learn about API automation and multi-bank visibility, check SprintNXT APIs

Common Types of Reconciliation Errors

Businesses often encounter:

1. Duplicate Payments

Same payment recorded twice due to manual oversight.

2. Unmatched Entries

Payment received but no corresponding invoice identified.

3. Incorrect Invoice Mapping

Amount paid does not match the invoice or wrong customer is mapped.

4. Missing Transactions

Payments not recorded due to communication gaps or system issues.

5. Bank Posting Delays

Transactions appearing late in bank statements.

These mistakes disrupt the accuracy of financial records.

Impact of Reconciliation Errors on Businesses

Reconciliation errors may seem small, but the impact can be significant:

Cash flow mismanagement

Delays in accounting and audits

Operational bottlenecks

Vendor payment delays

Customer disputes

Higher administrative workload

Financial inaccuracies affecting decision-making

Over time, recurring errors can damage credibility and increase compliance risks.

To improve vendor payouts, explore automated payout workflows

How to Prevent Reconciliation Errors

Businesses can eliminate most reconciliation errors by adopting structured processes:

1. Use standardized invoice formats

Ensures clarity and reduces mismatches.

2. Automate payment reminders

Customers pay with the correct references.

3. Reduce manual data entry

Digital tools minimize input errors.

4. Monitor transactions daily

Helps detect discrepancies early.

5. Centralize all payment channels

Use a unified system to track collections.

6. Use virtual accounts and UPI IDs

Assign unique identifiers to customers or invoices.

When businesses streamline collection systems, reconciliation becomes faster and more reliable.

How Digital Platforms Automate Reconciliation

Unified business banking platforms like SprintNXT simplify reconciliation through automation.

With features such as:

Auto-matching of payments

Virtual accounts for every customer or invoice

Real-time transaction syncing

UPI and bank transfer tracking

Multi-bank account visibility

Automated payout and collection workflows

SprintNXT helps businesses eliminate manual matching, reduce errors, and maintain accurate financial records.

This leads to:

Faster closing cycles

Improved cash flow visibility

Lower admin workload

Better financial control

Conclusion

Reconciliation errors are common but avoidable. With increasing digital payments and higher transaction volumes, manual reconciliation is no longer practical for growing SMEs.

By using automated tools, structured workflows, and virtual accounts, businesses can eliminate errors, improve financial accuracy, and focus more on growth than paperwork.

Platforms like SprintNXT offer automated reconciliation and real-time financial visibility — making it easier for SMEs and enterprises to run their operations smoothly.

Frequently Asked Questions (FAQs)

1. What causes reconciliation errors?

Manual data entry, missing references, duplicate payments, and multiple payment channels.

2. How can businesses reduce reconciliation errors?

By automating collections, standardizing invoices, using virtual accounts, and tracking payments regularly.

3. What is automated reconciliation?

A system that automatically matches incoming payments with invoices or customers.

4. Why is reconciliation important?

It ensures accurate financial records, better cash flow management, and smooth operations.

5. Can digital platforms help automate reconciliation?

Yes. Solutions like SprintNXT auto-match transactions, track multi-bank accounts, and provide real-time visibility.