The Payment Methods: Choosing the RIGHT Way to Pay in 2025

Payment methods refer to the various options available for customers to pay for goods or services. They can be online or offline, digital or physical, depending on the type of transaction.

For instance, you're standing at the checkout counter with your favorite snacks, but when you reach for your wallet, you realize you only have a $100 bill for a $5 purchase. The cashier gives you that look, & you start to panic. Sound familiar? We've all been there! The way we pay for things has changed SO much over the years, and it's amazing when you think about it.

From the days when people traded chickens for bread to our current world where you can pay with just a tap of your phone, payment methods have come a LONG way. But with so many options available today, how do you know which one is best for different situations? Should you stick with good old cash, embrace the convenience of credit cards, or jump on the digital wallet bandwagon?

In this guide, we'll explore everything you need to know about payment methods.

Table of Contents

What are the 3 methods of payment in banking

What is an advantage of digital cash over traditional payment methods?

What are the types of payment methods?

What are popular online payment methods?

Benefits of Using Online Payments

What are the 3 methods of payment in banking

What is an advantage of digital cash over traditional payment methods?

What are the types of payment methods?

What are popular online payment methods?

Benefits of Using Online Payments

What are the 3 methods of payment in banking

In banking, the three primary methods of payment are:

1. Cash Payment

Involves the physical exchange of currency (notes and coins)

Common for in-person transactions.

Does not require a bank account for the customer.

2. Cheque Payment

A written order from a bank account holder to their bank, instructing it to pay a specific amount to a person or organization.

Used mostly for official, large, or delayed payments

Requires clearance through the banking system.

3. Electronic Payment (E-Payment)

Involves transferring money digitally through banking systems.

Includes:

NEFT (National Electronic Funds Transfer)

RTGS (Real Time Gross Settlement)

IMPS (Immediate Payment Service)

UPI (Unified Payments Interface)

Fast, secure, and widely used for both personal and business transactions.

What is an advantage of digital cash over traditional payment methods?

An advantage of digital cash over traditional payment methods is convenience and speed.

Instant transactions: Digital cash (like UPI, digital wallets, or mobile banking) allows real-time payments, unlike cheques or cash, which take more time.

No need for physical presence: You can send or receive money anytime, anywhere, without visiting a bank or handling physical currency.

24/7 availability: Digital payments work around the clock, including holidays.

Easier tracking: Every transaction is recorded, making it easy to track your spending and manage finances.

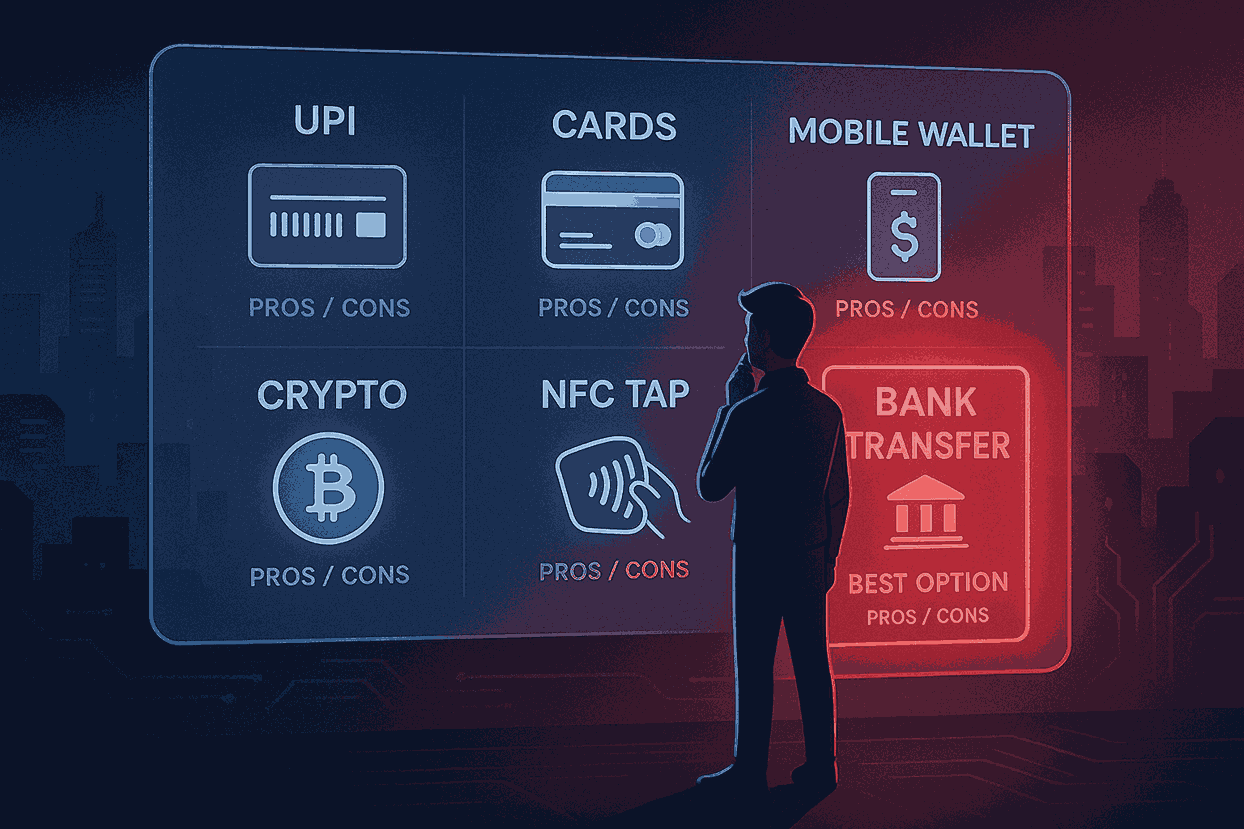

What are the types of payment methods?

There are several different kinds of payment methods used for both online and offline transactions. Here’s a breakdown of the most common ones:

1. Cash Payment

Physical currency (notes and coins).

Used for in-person transactions.

No digital record unless manually noted.

2. Card Payment

Debit Card: Money is directly deducted from your bank account.

Credit Card: Borrowed money from the bank, to be paid later with or without interest.

3. UPI (Unified Payments Interface)

Real-time mobile payment method in India.

Examples: Google Pay, PhonePe, Paytm, BHIM.

Fast, secure, and widely used.

4. Net Banking / Internet Banking

Payments are made via the bank’s online portal.

Requires login credentials and OTP verification.

5. Digital Wallets

Apps or platforms where money can be stored digitally.

Examples: Paytm Wallet, Amazon Pay, Mobikwik, Freecharge.

6. Bank Transfers

Direct transfer from one bank account to another.

NEFT (National Electronic Funds Transfer)

RTGS (Real-Time Gross Settlement)

IMPS (Immediate Payment Service)

7. Cheque

A paper-based method instructs a bank to pay a specific amount.

Used mostly for large or formal payments.

8. EMI (Equated Monthly Installments)

Pay for a product or service in fixed monthly payments.

Offered by banks or payment platforms.

9. Buy Now, Pay Later (BNPL)

Allows you to buy items and pay at a later date or in parts.

Examples: Simpl, LazyPay, ZestMoney.

10. Cryptocurrency

Digital currency is used in some online platforms.

Examples: Bitcoin, Ethereum.

Still not widely accepted or regulated.

Read more: Payment Gateway

What are popular online payment methods?

Popular Online Payment Methods (2025)

Here are the most commonly used online payment methods for digital transactions:

1. Debit and Credit Cards

Widely accepted for online shopping and services.

Examples: Visa, Mastercard, RuPay, American Express.

2. UPI (Unified Payments Interface)

Real-time payment systems are popular in India.

Linked directly to your bank account.

Examples: Google Pay, PhonePe, Paytm, BHIM.

3. Digital Wallets

Allow users to store money and make payments online.

Examples: Paytm Wallet, Amazon Pay, Mobikwik, Freecharge.

4. Net Banking

Internet-based banking is provided by banks.

Used for direct online payments and bill payments.

5. Buy Now, Pay Later (BNPL)

Pay in installments or after a fixed period.

Examples: LazyPay, Simpl, ZestMoney.

6. Payment Gateways

Platforms that process online payments securely.

Examples: Razorpay, CCAvenue, Stripe, PayPal, PayU.

7. Cryptocurrency (Limited Use)

Digital currency is used on selected websites.

Examples: Bitcoin, Ethereum.

Learn more about: UPI Collection

Benefits of Using Online Payments

Online payments offer a wide range of advantages for both individuals and businesses. Here are the key benefits:

1. Convenience:

Make payments anytime, anywhere using a phone or computer.

No need to visit a bank or ATM.

2. Speed:

Transactions are processed instantly or within seconds (especially with UPI, cards, or wallets).

Reduces waiting time compared to cheques or bank visits.

3. Security

Encrypted transactions with OTPs, biometrics, and PINs.

Reduced risk of theft compared to carrying cash.

4. Easy Record Keeping

Digital receipts and transaction history are automatically stored.

Useful for budgeting and tracking expenses.

5. Contactless Payments

No physical contact required – ideal for hygiene and safety (e.g., during the COVID-19 era).

Scan-and-pay systems reduce the need to handle cash.

6. Discounts & Rewards

Many apps offer cashback, discounts, loyalty points, and special offers.

7. 24/7 Availability

Online payments can be made around the clock, including weekends and holidays.

8. Global Reach

Pay or receive money across the world without geographical limits.

Supports international e-commerce and freelancing.

9. Reduced Operational Cost (for businesses)

Less cash handling and fewer staff are needed for physical transactions.

Speeds up checkout processes in online and retail stores.

10. Eco-Friendly

Reduces the need for paper bills, receipts, and cheques.

What are the types of payment methods?

There are several different kinds of payment methods used for both online and offline transactions. Here’s a breakdown of the most common ones:

1. Cash Payment

Physical currency (notes and coins).

Used for in-person transactions.

No digital record unless manually noted.

2. Card Payment

Debit Card: Money is directly deducted from your bank account.

Credit Card: Borrowed money from the bank, to be paid later with or without interest.

3. UPI (Unified Payments Interface)

Real-time mobile payment method in India.

Examples: Google Pay, PhonePe, Paytm, BHIM.

Fast, secure, and widely used.

4. Net Banking / Internet Banking

Payments are made via the bank’s online portal.

Requires login credentials and OTP verification.

5. Digital Wallets

Apps or platforms where money can be stored digitally.

Examples: Paytm Wallet, Amazon Pay, Mobikwik, Freecharge.

6. Bank Transfers

Direct transfer from one bank account to another.

NEFT (National Electronic Funds Transfer)

RTGS (Real-Time Gross Settlement)

IMPS (Immediate Payment Service)

7. Cheque

A paper-based method instructs a bank to pay a specific amount.

Used mostly for large or formal payments.

8. EMI (Equated Monthly Installments)

Pay for a product or service in fixed monthly payments.

Offered by banks or payment platforms.

9. Buy Now, Pay Later (BNPL)

Allows you to buy items and pay at a later date or in parts.

Examples: Simpl, LazyPay, ZestMoney.

10. Cryptocurrency

Digital currency is used in some online platforms.

Examples: Bitcoin, Ethereum.

Still not widely accepted or regulated.

Related article: UPI-Collection-API

Cash: The Old Reliable Payment Method

Cash might seem OLD-FASHIONED in our digital world, but don't count it out just yet! There's something special about holding real money in your hands. When you pay with cash, you know exactly how much you're spending because you can see it disappear from your wallet. It's like having a built-in spending tracker that you can't ignore.

One of the BIGGEST advantages of cash is that it's accepted everywhere. You'll never find yourself stuck because "the card reader is broken" or "we don't take that type of payment." Cash works at garage sales, farmer's markets, food trucks, & even when you need to tip your hairdresser. Plus, there are no fees involved – what you spend is what you spend, period.

However, cash does have its downsides. If you lose it, it's gone FOREVER. There's no calling the bank to cancel stolen cash like you would with a credit card. Also, carrying large amounts of cash can make you a target for theft. Have you ever tried to buy something expensive with cash? It can feel pretty nerve-wracking walking around with hundreds of dollars in your pocket.

Another thing to consider is that cash doesn't help you build credit history. When you're trying to get a car loan or mortgage later in life, banks want to see that you've been responsible with borrowed money. Cash purchases don't show up on credit reports, so you're missing out on opportunities to prove you're trustworthy with money.

Credit Cards: Your Financial Superpower (When Used Wisely)

Credit cards are like having a financial SUPERPOWER, but as we all know, with great power comes great responsibility. When you use a credit card, you're essentially borrowing money from the bank & promising to pay it back later. This can be incredibly convenient, but it can also get you into trouble if you're not careful.

The benefits of credit cards are pretty impressive. First, they offer AMAZING protection against fraud. If someone steals your credit card information & goes on a shopping spree, you're typically only responsible for $50 or less. Compare that to cash, where stolen money is just gone! Credit cards also help you build credit history, which is super important for your financial future.

Many credit cards come with rewards programs that give you cash back, points, or miles for every dollar you spend. It's like getting paid to shop! Some cards offer special perks like extended warranties on purchases, travel insurance, or access to exclusive events. Have you ever thought about earning money just by paying for things you were going to buy anyway?

But here's where things get TRICKY. Credit cards make it easy to spend money you don't have. The average American household carries over $6,000 in credit card debt, & the interest rates can be brutal – sometimes over 20% per year! If you only make minimum payments, you could end up paying twice as much for everything you buy. That $500 TV could end up costing you $1,000 if you're not careful with payments.

Debit Cards: The Perfect Middle Ground

Debit cards are like the PERFECT compromise between cash & credit cards. When you use a debit card, the money comes directly out of your bank account, so you can't spend more than you have. It's like carrying cash, but with way more convenience & security.

One of the best things about debit cards is that they help you stay within your budget automatically. You literally cannot overspend because the card will be declined if you don't have enough money in your account. This built-in spending limit can be a real lifesaver for people who struggle with impulse purchases or staying on budget.

Debit cards are accepted almost everywhere credit cards are accepted, & they're much more convenient than cash. You don't have to worry about having exact change or getting a bunch of coins back. Plus, you can use your debit card to get cash from ATMs when you need it, which is super handy.

However, debit cards don't offer the same LEVEL of fraud protection as credit cards. While you're still protected, the process of getting your money back can take longer, & in the meantime, that money is missing from your account. Imagine if someone steals your debit card information & drains your checking account right before rent is due – that's a real problem!

Another downside is that debit cards don't help build credit history. Since you're using your own money rather than borrowing, these transactions don't show up on credit reports. If building credit is important to you, debit cards won't help you reach that goal.

Digital Wallets: The Future is Here

Digital wallets like Apple Pay, Google Pay, & Samsung Pay are becoming incredibly POPULAR, & it's easy to see why. These apps store your payment information securely on your phone, allowing you to pay for things with just a tap or scan. It feels like something straight out of a science fiction movie!

The security features of digital wallets are pretty amazing. Instead of sharing your actual credit card number with merchants, these apps create unique transaction codes for each purchase. Even if hackers intercept this information, they can't use it for other purchases. Your real payment information stays safely locked away on your device.

Digital wallets are also incredibly convenient. How many times have you left your wallet at home but still had your phone? With a digital wallet, your phone becomes your wallet. You can store multiple credit cards, debit cards, & even loyalty cards all in one place. Some apps even let you store boarding passes, event tickets, & gift cards.

But digital wallets aren't PERFECT. They require your phone to have battery power & a working internet connection. If your phone dies while you're out shopping, you're out of luck. Also, not all merchants accept digital payments yet, especially smaller businesses or older establishments. Have you ever tried to pay with your phone only to get a confused look from the cashier?

Buy Now, Pay Later: The New Kid on the Block

Buy now, pay later (BNPL) services like Afterpay, Klarna, & Affirm have exploded in popularity, especially among younger shoppers. These services let you split your purchase into smaller payments over time, usually without charging interest if you pay on schedule. It sounds pretty appealing, right?

The main advantage of BNPL is that it makes expensive purchases more manageable. Instead of paying $200 for shoes all at once, you might pay $50 every two weeks for eight weeks. This can help you budget better & avoid putting large purchases on high-interest credit cards. Many BNPL services don't require a credit check, making them accessible to people with limited credit history.

However, BNPL can be a double-edged sword. It's easy to forget about all those future payments when you're excited about your new purchase. If you use multiple BNPL services for different purchases, you could end up with payment due dates scattered throughout the month. Missing payments can result in late fees & could potentially hurt your credit score.

The convenience of BNPL can also encourage overspending. When you can break any purchase into smaller chunks, it's tempting to buy things you can't afford. Before you know it, you might have committed to hundreds of dollars in future payments for things you don't need.

Choosing the Right Payment Method for Different Situations

Now that we've covered the main payment options, let's talk about WHEN to use each one. The best payment method often depends on what you're buying, where you're shopping, & your personal financial goals.

For everyday purchases like groceries, gas, or coffee, debit cards or digital wallets are usually your best bet. They're convenient, secure, & help you stick to your budget since you're using money you have. If your credit card offers good rewards for these categories & you're disciplined about paying it off, credit cards can work too.

When you're making large purchases, credit cards often provide the best protection. The extended warranties, purchase protection, & superior fraud coverage can be valuable for expensive items. Just make sure you have a plan to pay off the balance quickly to avoid interest charges.

For small purchases at local businesses, farmers' markets, or food trucks, cash is often the most appreciated payment method. Small businesses pay fees when they accept card payments, so cash helps them keep more of their profits. Plus, cash transactions are quick & don't require any technology that might break down.

Read more about: Cash Management Solutions for Retail Chains

Making Smart Payment Decisions for Your Future

Understanding payment methods isn't just about convenience – it's about making smart financial decisions that can impact your future. The payment methods you choose today can affect your credit score, your spending habits, & your overall financial health.

If you're just starting your financial journey, focus on building good habits with debit cards & cash while you learn to budget effectively. Once you're comfortable managing your money, consider adding a credit card to start building credit history. Remember, the goal isn't to use every payment method available – it's to use the ones that work best for your situation & help you reach your financial goals.

Think about your spending patterns & be honest about your self-control. If you tend to overspend when payment feels "easy," stick with cash or debit cards that force you to stay within your means. If you're disciplined & want to earn rewards while building credit, credit cards can be powerful tools.

The world of payments will continue to evolve, with new technologies & services appearing regularly. Stay informed about your options, but don't feel pressured to adopt every new payment trend. The best payment method is the one that helps you spend responsibly, stay secure, & work toward your financial goals. What matters most is finding the approach that works for YOUR unique situation & sticking with it consistently.

Read more about: Banking API Solutions

Conclusion: Payment Method

A payment gateway is a vital tool in today’s digital economy, enabling businesses to securely accept online payments from customers. It acts as a bridge between the customer, the merchant, and the bank, ensuring that transactions are processed safely, quickly, and efficiently. With the rise of e-commerce and digital payments, using a reliable payment gateway not only improves the customer experience but also helps businesses expand their reach, reduce manual efforts, and build trust through secure transactions.

FAQs: Payment Method

Which payment method is fast?

UPI (Unified Payments Interface) is the fastest payment method currently available. It allows instant money transfers between bank accounts, works 24/7 (including weekends and holidays), and is widely used in India through apps like Google Pay, PhonePe, Paytm, and BHIM.

What is a payment technique?

A payment technique is the way money is given by a buyer to a seller to pay for goods or services. It shows how the payment is made — whether online, in cash, quickly, or in parts over time.

What are examples of payment methods?

Here are some common examples of payment methods used in everyday transactions:

Cash,

Debit Card,

Credit Card, UPI,

Digital Wallet,

Net Banking,

Bank Transfer,

Cheque,

Buy Now Pay Later

Cryptocurrency

Which payment method is best?

For most users in India, UPI is the best payment method due to its speed, simplicity, and zero transaction cost. But the "best" option depends on your purpose and convenience.

What is the payment method?

The Payment Method is the way a customer settles a bill for goods and services. This can be through various methods, including Cash, Credit Card, Debit Card, Digital wallet, and more.