Escrow Digital Wallets for Marketplaces: How SprintNXT Powers Secure, Neutral Transaction Holding

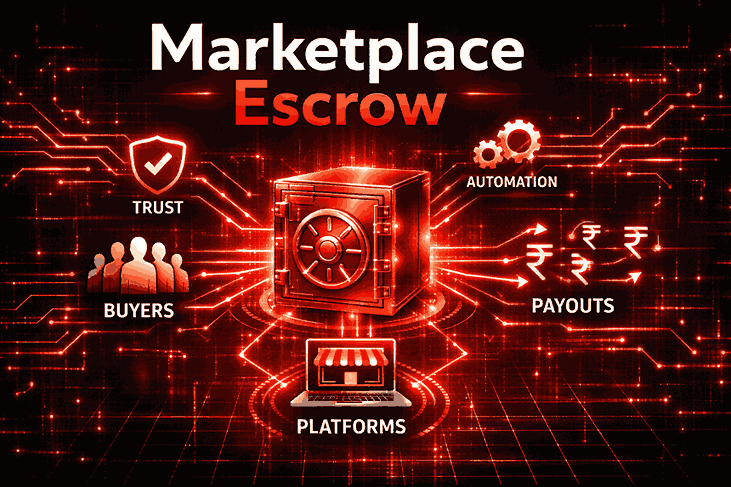

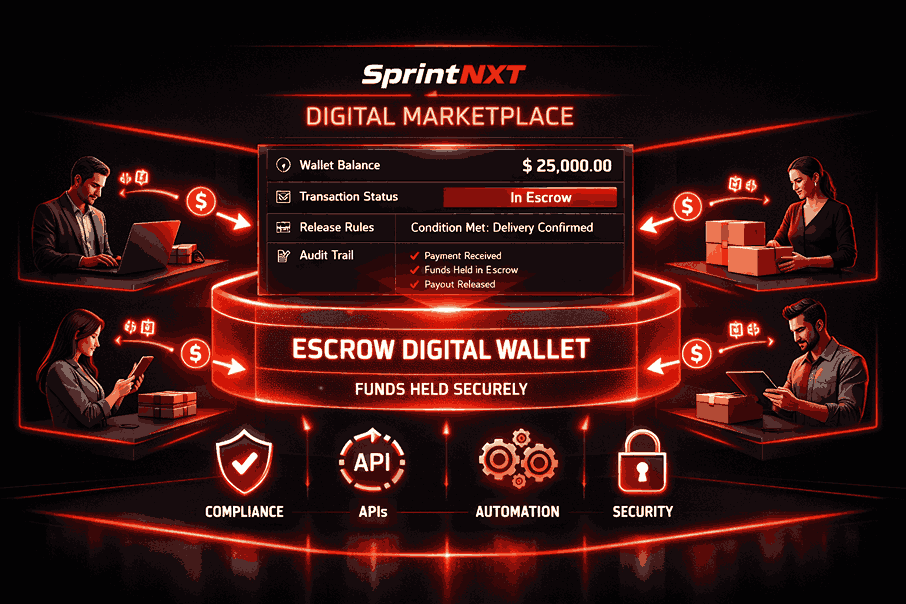

In escrow, a digital wallet acts as a secure, neutral online account holding funds or assets for a transaction until agreed conditions are met. This structure ensures that money is neither with the buyer nor the seller directly, but in a protected space, drastically reducing fraud and disputes.

For platforms built on SprintNXT and PaySprint’s escrow stack, such a wallet is not just a balance on a screen; it is a programmable node that connects bank accounts, payment rails, and business rules into one trusted flow.

This programmability is enabled through API-first banking infrastructure that links wallet events directly to collections, payouts, and reconciliation.

Table of Contents

What is an Escrow Digital Wallet?

Why Platforms Use Escrow Wallets

How an Escrow Wallet Works in a Transaction

Where SprintNXT Fits in the Escrow Wallet Journey

Use Cases: Wallet-Based Escrow on SprintNXT

Steps to Implement an Escrow Wallet with SprintNXT

Conclusion

Frequently Asked Questions

What is an Escrow Digital Wallet?

In an escrow context, a digital wallet is a secure, neutral online account that temporarily holds funds or assets for a transaction until certain conditions—such as delivery, acceptance, or milestone completion—are met. It acts as an interim parking layer where the buyer’s money is locked but not yet released to the seller.

Unlike consumer wallets that users top up and spend from directly, an escrow wallet is transaction-bound and rules-based, created and managed to serve a specific trade, order, or project. It is typically backed by bank accounts and trustee or escrow arrangements under a regulated framework.

Escrow wallets are often funded using UPI-based collection systems that provide fast settlement and clear payer identification.

Why Platforms Use Escrow Wallets

Platforms—especially marketplaces, gig and service platforms, and B2B portals—use escrow digital wallets for three core reasons.library?

Trust and safety: Funds are held by a neutral system, not by either party, reducing fear of non-delivery or non-payment.

Dispute management: If something goes wrong, the platform can hold, split, or refund funds from the escrow wallet as per policy, without messy reversals.

Operational control: The platform can encode business logic (timelines, milestones, penalties, partial releases) in the way the wallet holds and moves funds.

This makes escrow wallets especially powerful for high-value, delayed-delivery, or service-based transactions.

How an Escrow Wallet Works in a Transaction

The life cycle of an escrow digital wallet on a platform typically follows a clear, programmable sequence.

Transaction creation

A buyer initiates an order or agreement on the platform (product purchase, service contract, project, booking, etc.).

Wallet allocation

The system creates or tags a dedicated escrow wallet or sub-wallet for that transaction, linked to both buyer and seller and backed by a bank/escrow account.

Funding the wallet

The buyer pays into the escrow wallet using UPI, cards, net banking, or bank transfer. Funds land in the underlying escrow account but are tracked against this digital wallet balance.

Holding phase

The wallet holds the funds until conditions like shipment, delivery, service completion, or milestone approvals are met. During this time, no party can unilaterally withdraw.

Release or refund

On successful completion, funds move from the escrow wallet to the seller’s bank account; in case of failure or dispute resolution, money may be refunded back to the buyer or split as per rules.

Reconciliation and closure

The platform records all entries for audit, reporting, and reconciliation with bank accounts and its own ledgers.

Where SprintNXT Fits in the Escrow Wallet Journey

SprintNXT is PaySprint’s connected banking platform that centralizes collections, payouts, and reconciliation over multiple bank accounts. In an escrow wallet context, SprintNXT provides the banking and transaction orchestration layer under the wallet interface.

Key roles SprintNXT can play:

Multi-mode collections into escrow: Accept buyer payments via UPI, virtual accounts, and other rails into the underlying escrow bank account mapped to digital wallets.

Automated payouts from escrow: Once a wallet moves to “release” status, SprintNXT handles disbursals to seller bank accounts via IMPS/NEFT/RTGS/UPI.

Real-time reconciliation: Match wallet-level events (funding, holds, releases) with bank account entries, providing finance teams with clear visibility.

These capabilities are delivered through SprintNXT’s unified business banking platform, which abstracts bank complexity behind APIs and dashboards.

Use Cases: Wallet-Based Escrow on SprintNXT

Platforms using SprintNXT and PaySprint’s escrow stack can design wallet-based escrow workflows for multiple verticals.

Marketplaces (products and services)

Create per-order or per-project escrow wallets that hold funds until delivery or service completion, then trigger payouts via SprintNXT.

Gig and freelancer platforms

Use escrow wallets for project milestones, where each phase is funded, completed, and then released, reducing disputes and payment delays.

B2B trade and procurement portals

Implement escrow wallets for high-value or cross-city trade, protecting both buyer and seller while centralizing reconciliation.

Real estate, rentals, and deposits

Hold deposits or advance payments in escrow wallets and release them based on contract conditions or move-out inspections.

Steps to Implement an Escrow Wallet with SprintNXT

Platforms looking to adopt escrow wallets with a connected banking stack can follow a structured approach.?

Define transaction rules

Decide when a wallet is created, how long funds are held, what constitutes “completion,” and what happens in disputes.

Map wallet states to banking flows

Align wallet states—funded, on-hold, releasable, refunded—with collections and payouts through SprintNXT and the escrow account.

Integrate via APIs

Connect your platform to SprintNXT’s APIs for collections, payouts, and webhooks so wallet events automatically trigger banking actions.

Align with escrow setup

Coordinate with PaySprint’s escrow service for trustee structures, KYC/KYB requirements, and regulatory compliance for holding user funds.

Monitor and optimize

Track metrics like average hold time, dispute frequency, and payout timelines through SprintNXT’s dashboards to refine rules.

For onboarding guidance or escrow architecture discussions, platforms can contact SprintNXT directly

Conclusion

In escrow, a digital wallet is much more than a simple balance; it is a secure, neutral holding layer that underpins trust for every transaction. By locking funds until the right conditions are met, escrow wallets protect buyers and sellers and give platforms a powerful lever to control risk and experience.

With SprintNXT as the connected banking switch and PaySprint’s Escrow-as-a-Service capability underneath, platforms can design and scale wallet-based escrow flows that are secure, compliant, and deeply integrated with their core product. This combination turns the simple idea of a “wallet” into a strategic infrastructure element for modern marketplaces and digital ecosystems.

Frequently Asked Questions

What is a digital wallet in escrow?

A digital wallet in escrow is a secure, neutral online account that temporarily holds funds or assets for a transaction until conditions like delivery or approval are met.How is an escrow wallet different from a regular wallet?

A regular wallet is for day-to-day spending by the user, while an escrow wallet is rules-based and tied to specific transactions, holding funds neutrally until release or refund.Why should marketplaces use escrow wallets?

Escrow wallets reduce fraud, improve trust, and give platforms structured control over when and how funds move between buyers and sellers.How does SprintNXT support escrow wallets?

SprintNXT powers the underlying collections, payouts, and reconciliation flows linked to escrow wallets, connecting them to real bank accounts and payment rails.Can an escrow wallet handle multiple milestones?

Yes, platforms can design escrow wallets to release funds in stages based on milestones or partial completions, especially in services, projects, or construction-style work.