Marketplace Escrow for Digital Marketplaces with SprintNXT

Digital marketplaces in India—from e-commerce platforms and gig marketplaces to B2B trade portals—run on one fragile foundation: trust between people who usually do not know each other. A single dispute, delayed refund, or failed delivery can quickly damage user confidence and increase support and chargeback costs for the platform.

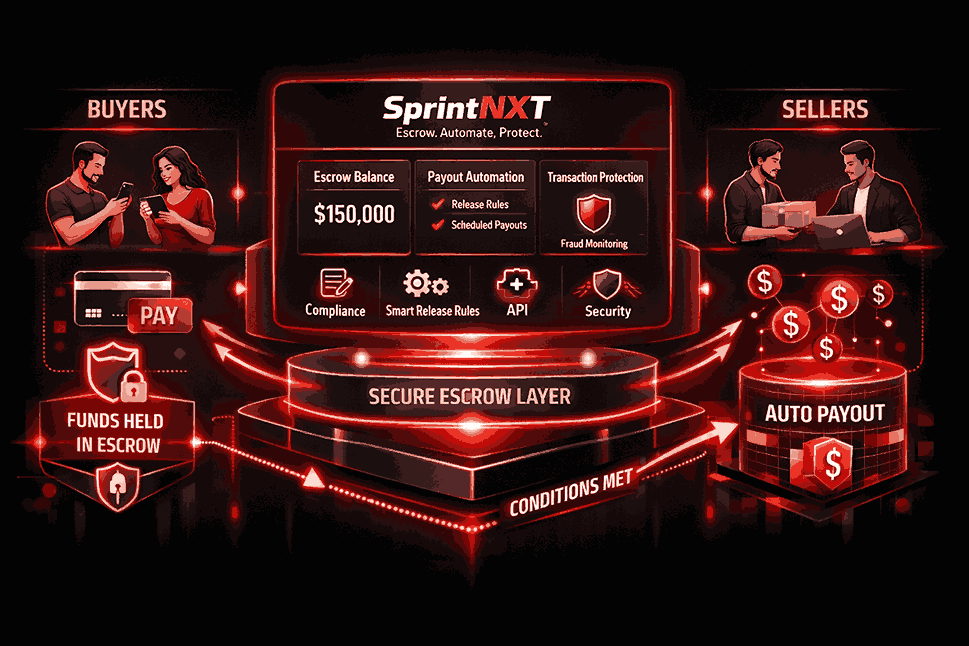

Marketplace escrow solves this by placing a neutral, trusted third party between buyer and seller, holding the buyer’s money safely until the seller fulfills agreed conditions like delivery, acceptance, or service completion. With SprintNXT’s connected banking rails and PaySprint’s escrow infrastructure (SprintEXcrow), marketplaces can embed this protection directly into their payment flows—without building complex banking and compliance layers from scratch.

To understand how unified banking powers such flows, explore SprintNXT here

Table of Contents

What is a Marketplace Escrow?

Why Marketplaces Need Escrow Today

How Marketplace Escrow Works (Step by Step)

Key Benefits for Marketplaces, Buyers, and Sellers

Where SprintNXT Fits in the Marketplace Escrow Journey

Marketplace Use Cases Powered by SprintNXT + Escrow

How to Get Started as a Marketplace with SprintNXT

Conclusion

Frequently Asked Questions

What is a Marketplace Escrow?

Marketplace escrow is a financial arrangement where a neutral third party holds a buyer’s payment securely and releases it to the seller only after the transaction conditions are met. In simple terms, the buyer pays into an escrow account, the seller delivers the product or service, and money is released only when both sides confirm that everything is as agreed, protecting both parties from fraud and non-performance.

Unlike traditional “pay at order” flows where funds move instantly to sellers, marketplace escrow creates a secure middle layer that tracks obligations, milestones, and approvals before any payout happens. For digital marketplaces, this is especially powerful in high-value, delayed-delivery, or service-based transactions where disputes are more likely.

Why Marketplaces Need Escrow Today

Modern marketplaces face three big challenges: fraud risk, disputes, and trust deficit among first-time users. Buyers fear paying and not receiving what was promised, while sellers fear delivering goods or services and then not getting paid on time.

Escrow helps marketplaces:

Reduce fraud and chargebacks by holding funds until delivery or acceptance is verified.

Improve user trust and conversion because new users feel safer paying through a protected flow rather than direct bank transfers or unknown wallets.

Simplify compliance and auditability by routing sensitive funds through structured, trackable, and bank-backed accounts instead of scattered manual payments.

For marketplaces collecting payments via UPI or bank transfers, this guide may be useful

How Marketplace Escrow Works (Step by Step)

A typical marketplace escrow flow can be broken into clear steps that SprintNXT and PaySprint’s escrow stack can automate end-to-end for platforms.

Order initiation

Buyer selects a product or service on the marketplace and agrees to terms such as price, delivery timeline, and return/refund conditions.

Secure payment to escrow

Instead of paying directly to the seller, the buyer pays into a dedicated escrow account via UPI, cards, net banking, or bank transfers routed through SprintNXT’s multi-mode payment rails.

Confirmation and notification

Once funds are received in escrow, the seller and marketplace get real-time confirmation that the money is securely parked and reserved for this transaction.

Delivery or service fulfillment

The seller ships the product or completes the service, while the marketplace tracks status through its own workflows and potentially logistics or task-management systems.

Buyer acceptance or dispute

Buyer confirms successful delivery/quality within a defined window. If there is a problem, the marketplace can hold or reverse the escrow payout as per policy.

Once conditions are met, escrow releases funds to the seller’s bank account using SprintNXT’s automated payout APIs (IMPS, NEFT, RTGS, UPI), logging all details for reconciliation and reporting.

This structure gives marketplaces a clean, programmable layer between collections and payouts, allowing them to embed trust, rules, and dispute logic directly into their financial flows.

Key Benefits for Marketplaces, Buyers, and Sellers

With SprintNXT and PaySprint’s Escrow-as-a-Service stack, marketplace escrow becomes more than just a safety feature—it becomes a growth and efficiency driver.

For the marketplace platform

Lower fraud and disputes: Funds stay locked until platform-defined conditions are satisfied, reducing refunds, chargebacks, and support overhead.

Stronger brand trust: Positioning as a marketplace that safeguards every transaction improves acquisition, especially among first-time users and high-value segments.

Operational automation: SprintNXT automates collections, payouts, and reconciliation, freeing teams from manual tracking and settlement pain.

For buyers

Payment safety: Money is held by a neutral, bank-backed escrow entity instead of going directly to an unknown seller.

Clear recourse: If something goes wrong, escrow gives buyers a structured way to raise disputes before the seller is paid.

Confidence in higher-ticket purchases: Buyers feel more comfortable purchasing expensive or service-based offerings when funds are protected until successful completion.

For sellers

Guaranteed funds once conditions are met: Sellers know that money is already secured in escrow and will be released automatically after delivery or acceptance.

Faster settlements at scale: With SprintNXT’s automated payouts, sellers receive funds quickly and consistently, improving cash flows and satisfaction.

More orders from trust-conscious buyers: When buyers see escrow on a marketplace, they are more likely to transact, especially with new or smaller sellers.

Where SprintNXT Fits in the Marketplace Escrow Journey

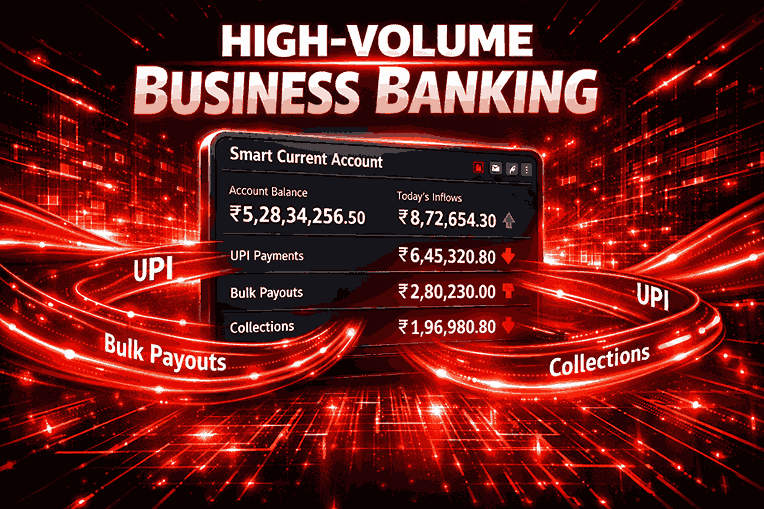

SprintNXT is PaySprint’s connected business banking platform that unifies collections, payouts, and reconciliation over multiple bank accounts in one intelligent dashboard and API layer. For marketplaces, it becomes the financial engine underneath escrow-based experiences.

Key SprintNXT capabilities relevant for marketplace escrow include:

Multi-mode collections: Accept buyer payments via UPI, QR codes, and bank transfers into mapped current accounts or escrow structures, with real-time status updates.

Automated payouts: Disburse funds to thousands of sellers through IMPS, NEFT, RTGS, and UPI once escrow release triggers fire, reducing manual work and errors.

Smart reconciliation and insights: Match collections to orders and payouts, track settlement timelines, and generate reports on marketplace performance and risk.

Paired with PaySprint’s SprintEXcrow Escrow-as-a-Service platform—which offers trustee-backed, compliant escrow accounts for digital platforms and marketplaces—SprintNXT completes the stack from secure fund holding to automated final settlement.

Learn more about SprintNXT’s API-first banking infrastructure

Marketplace Use Cases Powered by SprintNXT + Escrow

Marketplace escrow via SprintNXT and PaySprint’s escrow infrastructure is relevant across a wide range of Indian digital platforms.

E-commerce and resale marketplaces

High-value electronics, luxury goods, and refurbished items where buyers want a guarantee of authenticity and condition before payment is released.

SprintNXT routes buyer payments to escrow and automates release once delivery and quality checks are confirmed.

Services and gig marketplaces

Freelancing, on-demand professionals, and local services where work is delivered over time or in milestones.

Escrow holds funds for each project while SprintNXT handles milestone-based payouts tied to approvals.

B2B trade and wholesale platforms

Bulk orders, industrial supplies, and cross-city trade where buyers and sellers often transact for the first time.

Escrow protects both sides while SprintNXT offers multi-bank flexibility and real-time payment processing.

Edtech, travel, and subscription platforms

Course bundles, travel packages, or long-duration services where full value is delivered over time.

Funds can be held or released in phases, with SprintNXT orchestrating complex schedules and reconciliations.

How to Get Started as a Marketplace with SprintNXT

For marketplaces planning to introduce marketplace escrow for the first time, the journey can be broken into simple implementation steps.

Define transaction rules

Identify which categories, ticket sizes, or user segments should be routed through escrow and what conditions must be met for fund release.

Integrate SprintNXT APIs

Connect your marketplace backend with SprintNXT’s APIs for collections, payouts, virtual IDs, and reconciliation to manage the full payment lifecycle.

Configure escrow with PaySprint

Work with PaySprint’s Escrow-as-a-Service offering (like SprintEXcrow) to set up trustee-backed escrow accounts, KYC/KYB rules, and compliance workflows.

Design user communication

Clearly communicate to buyers and sellers how escrow works, when funds are held, and how release or refunds are triggered to reduce confusion and support tickets.

Monitor and optimize

Use SprintNXT’s dashboard and analytics to monitor success metrics such as dispute rate, average release time, and seller satisfaction, then refine rules over time.

Conclusion

Marketplace escrow is quickly becoming a default expectation for serious digital platforms, not just a “nice-to-have” safety net. By combining neutral third-party fund holding with programmable rules and automated settlement, it protects buyers, reassures sellers, and strengthens the marketplace brand.

SprintNXT, together with PaySprint’s Escrow-as-a-Service stack, allows marketplaces to embed marketplace escrow directly into their payment architecture—leveraging multi-bank connectivity, real-time collections, automated payouts, and smart reconciliation from a single integrated platform. For Indian marketplaces planning to scale responsibly, this mix of trust, speed, and control can become a powerful competitive advantage.

Frequently Asked Questions

What exactly is marketplace escrow?

Marketplace escrow is a system where a neutral third party holds buyer funds until the seller meets agreed conditions such as delivery or service completion, after which funds are released securely.How is marketplace escrow different from normal online payments?

In normal payments, money goes directly from buyer to seller, even if there is a later dispute, while in marketplace escrow funds remain locked in a controlled account until both parties fulfill their obligations.How does SprintNXT support marketplace escrow?

SprintNXT powers the banking layer of marketplace escrow by enabling multi-mode buyer collections, automated seller payouts, and smart reconciliation across multiple bank accounts from one connected platform.What role does PaySprint’s escrow stack play for marketplaces?

PaySprint’s Escrow-as-a-Service offering (such as SprintEXcrow) provides the compliant, trustee-backed escrow accounts where funds are held and released according to marketplace-defined rules and regulatory standards.Which types of marketplaces benefit most from escrow with SprintNXT?

High-value e-commerce, B2B trade, services and gig platforms, travel, and subscription-based marketplaces benefit most, especially where delivery is delayed, complex, or milestone-based.Can SprintNXT handle payouts to many sellers at once?

Yes, SprintNXT is designed as a business banking switch that supports bulk, automated payouts to multiple vendors, partners, or sellers using modes like IMPS, NEFT, RTGS, and UPI.Is marketplace escrow compliant with Indian banking regulations?

Escrow accounts offered through PaySprint’s Escrow-as-a-Service are set up with partner banks and dedicated trustees, helping digital platforms and marketplaces stay aligned with regulatory and compliance expectations in India.