Connected Banking in India | SprintNXT

Connected Banking in India | SprintNXT

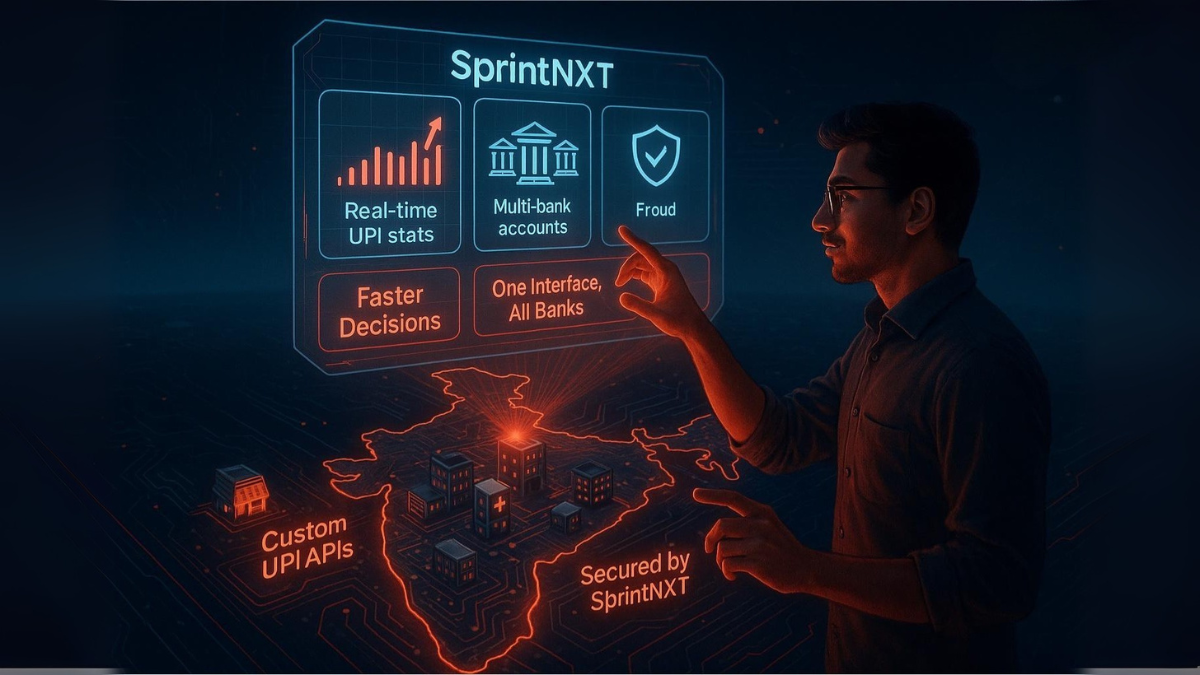

SprintNXT is a connected banking platform designed to simplify and elevate business financial operations. It serves as a powerful business banking switch, bringing together collections, payouts, multi-bank management, UPI payments, and real-time insights — all through a unified, API-driven platform. With SprintNXT, businesses can automate UPI collections, initiate seamless payouts, manage multiple bank accounts from a single dashboard, and gain deep visibility into cash flows and transactions.

Table of Contents

What is SprintNXT

Features of SprintNXT

Industries Served by SprintNXT

Benefits of Partnering with SprintNXT

Why Choose SprintNXT?

Conclusion

FAQs

What is SprintNXT

SprintNXT appears to be a business platform or service that focuses on business banking solutions with an emphasis on UPI (Unified Payments Interface) integration, secure payment processing, and multi-account management. It aims to provide businesses with an efficient, user-friendly platform for managing their banking needs, making financial transactions smoother and more secure.

Learn more: Sprintnxt. in

Features of SprintNXT

Digital Transformation Services: SprintNXT provides end-to-end digital solutions, enabling businesses to modernize operations and stay competitive in the digital era.

Integration: The platform easily integrates with existing systems, ensuring a smooth transition and uninterrupted workflows.

Customizable Solutions: SprintNXT tailors its services to fit the unique requirements of each business, providing personalized solutions that align with specific needs.

Customer Experience: SprintNXT enhances customer engagement through user-friendly interfaces and tools that improve the overall experience, from service delivery to client interactions.

Explore our: UPI API Collection

Industries Served by SprintNXT

E-commerce

Enable fast, seamless collections and automated payouts with real-time reconciliation across multiple payment modes.Startups

Agile, secure, and scalable payment infrastructure to support rapid growth, multi-bank operations, and financial automation.NBFCs & Lending Institutions

Secure loan disbursements, EMI collections, and high-volume repayments with end-to-end visibility and reconciliation.Travel & Agents

Simplify booking payments, advance collections, refunds, and agent payouts with faster settlements and transparency.Educational Institutions

Streamline fee collections and disbursements with automated tracking, reconciliation, and multi-mode payment support.Insurance

Optimize premium collections and claim payouts using UPI QR codes, automated workflows, and instant settlements.Financial Services

Automate recurring collections, vendor payouts, and cash flow management through a unified connected banking platform.

Benefits of SprintNXT

Saves Time and Effort: SprintNXT utilizes intelligent technology to streamline work, reducing manual tasks and saving valuable time.

Smarter Decisions: SprintNXT helps businesses make better decisions to achieve their goals.

Customized Solutions: Every business is unique, and SprintNXT provides personalized services to meet specific needs.

Strong Security: SprintNXT ensures your data is safe with advanced cybersecurity and protection against threats.

Easy to Use with Existing Systems: It works well with the tools and systems you already use, so you can upgrade without any hassle.

Why Choose SprintNXT?

SprintNXT stays up to date with the latest technology, offering cutting-edge solutions that keep businesses ahead of the curve. The company focuses on meeting customer needs with personalized service and excellent support. With a strong track record of successful projects in various industries, SprintNXT proves its expertise and adaptability.

Conclusion - SprintNXT

SprintNXT is more than just a service provider; it's a trusted partner dedicated to helping businesses thrive in today’s fast-evolving digital world. By offering innovative solutions, focusing on customer needs, and bringing expertise across multiple industries,

SprintNXT is driving business transformation for a brighter future.

FAQs – SprintNXT

What is SprintNXT?

SprintNXT is a connected banking and payments platform that helps businesses manage collections, payouts, and reconciliation through a unified dashboard and APIs.

How does SprintNXT help businesses collect payments?

SprintNXT enables seamless payment collection via UPI, QR codes, virtual IDs, and payment gateways with real-time settlement tracking.

What is UPI Collection in SprintNXT?

SprintNXT’s UPI Collection API allows businesses to accept UPI payments through intent, QR, and VPA while automating tracking and reconciliation.

Does SprintNXT support automated reconciliation?

Yes, SprintNXT automatically matches incoming payments with invoices and bank records, reducing manual reconciliation errors and delays.

Can I manage multiple bank accounts on SprintNXT?

SprintNXT offers multi-bank and multi-account management, giving businesses a consolidated view of balances and transactions in one place.

What payout solutions does SprintNXT provide?

SprintNXT offers automated payout APIs for vendors, sellers, and partners via UPI and bulk transfers with faster settlements.

Is SprintNXT suitable for startups and SMEs?

Yes, SprintNXT is built for startups and SMEs to scale payments, automate reconciliation, and improve cash flow efficiency.

Which industries does SprintNXT serve?

SprintNXT serves manufacturing, NBFCs, retail, marketplaces, education, travel, and real estate with industry-specific payment solutions.

How does SprintNXT help NBFCs and lending platforms?

SprintNXT simplifies high-volume loan repayments, identifies unidentified payments, and reduces multi-platform payment complexity.

Can SprintNXT integrate with existing systems?

Yes, SprintNXT offers easy API integrations with ERPs, CRMs, and accounting systems for seamless financial operations.

Does SprintNXT provide reports and analytics?

SprintNXT delivers real-time dashboards and reports for collections, payouts, and reconciliation to support better financial decisions.

How can I get started with SprintNXT?

You can book a demo on the SprintNXT website to explore features and start integrating payment and banking solutions.