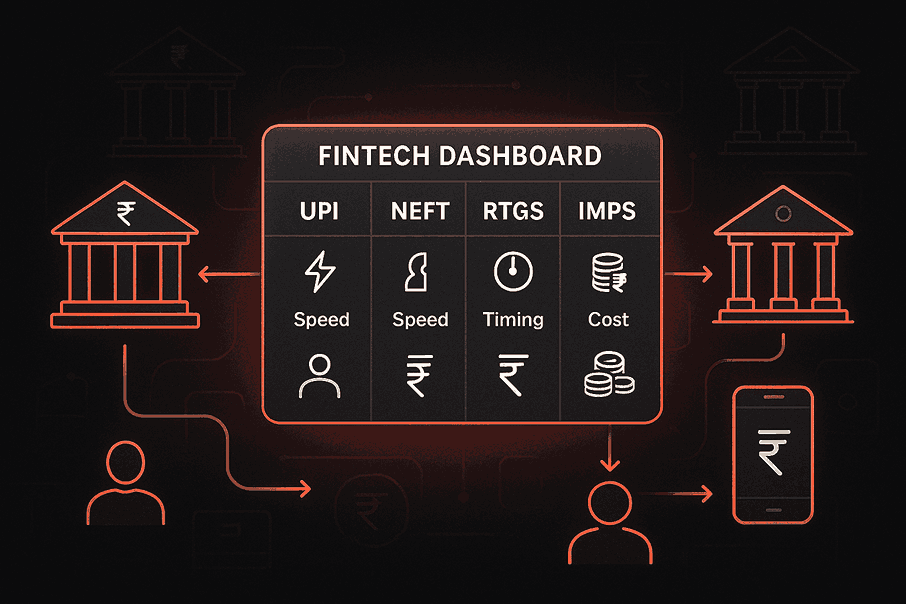

The Basics of UPI, NEFT, RTGS, and IMPS: Choosing the Best Payment Method

India’s

digital payments landscape offers several reliable options for transferring

money — each with its own strengths and ideal use cases. Understanding how UPI,

NEFT, RTGS, and IMPS work can help you make smarter choices for personal and

business payments. This guide explains each method, compares features, and

provides tips for picking the best payment solution for your needs.

Table of Contents

1.

What

Are UPI, NEFT, RTGS, and IMPS?

2.

Main

Features and How Each Works

3.

Pros

and Cons

4.

Tips

for Choosing the Right Method

5.

Frequently

Asked Questions

What Are UPI, NEFT, RTGS, and IMPS?

- UPI (Unified Payments

Interface): A

mobile-first, instant payment system, UPI lets users send money using apps

like Google Pay or PhonePe, using a simple VPA (Virtual Payment Address).

It’s widely used for everyday transactions.

- NEFT (National Electronic Funds

Transfer): NEFT

allows electronic transfers between all NEFT-enabled banks, ideal for

routine payments. It settles transactions in batches, so transfers may

take up to a few hours.

- RTGS (Real-Time Gross

Settlement):

RTGS is designed for large-value, urgent transactions over ?2 lakhs,

processed in real-time with no upper limit. It is used by businesses or

individuals needing immediate settlement.

- IMPS (Immediate Payment

Service): IMPS

transfers are instant and available 24/7, including holidays. Maximum

transfer limits depend on your bank, typically up to ?5 lakhs per

transaction.

Main Features and How Each Works

UPI:

1. Available 24/7

2. Quick, mobile-driven, free of charge

3. Transaction limit mostly ?1 lakh per

transfer (bank-dependent)

4. Can be used for P2P, business, bill

payments, and more

NEFT:

1. Available 24/7, but processes batches

every 30 minutes–2 hours

2. No minimum or maximum transfer limit

3. Needs beneficiary’s bank details and

IFSC

RTGS:

1. Real-time settlement, 24/7

2. Minimum transfer amount ?2 lakhs, no

upper limit

3. Used for high-value transactions.

IMPS:

1. Instant transfers (seconds), 24/7/365

2. ?1 minimum, ?5 lakhs maximum per day

(may vary by bank)

3. Useful for emergencies and routine

transfers

Pros and Cons

UPI

1. Pros: Free, user-friendly, instant,

mobile-based, works day & night

2. Cons: Transfer limit per transaction

is generally lower (?1 lakh)

NEFT

1. Pros: Safe, great for scheduled

payments, no transfer ceiling, widely accepted

2. Cons: Delays due to batch processing,

not ideal for emergencies

RTGS

1. Pros: Best for large-value, urgent

transactions with real-time settlement

2. Cons: Only for transfers ? ?2 lakh;

transaction cost can be higher

IMPS

1. Pros: Instant transfer, good for

small and medium values, accessible

2. Cons: Max limit capped at ?5 lakhs

per day, charges vary by bank

Tips for Choosing the Right Method

- Use UPI for daily

purchases, P2P payments, bill payments, and micro-business transactions.

- Choose NEFT for scheduled

or routine payments, when value is not huge or instant settlement isn’t

needed.

- Prefer RTGS for urgent,

high-value business payments over ?2 lakhs.

- Opt for IMPS when you

need instant or emergency transfers up to ?5 lakhs at any time.

Frequently Asked Questions

Q1: Are these payment systems secure?

All four

methods are regulated by RBI/NPCI and use strong authentication and encryption

standards.

Q2: Can I reverse a wrong transaction?

Wrong

transfers need you to contact your bank and sometimes escalate to NPCI for

reversal and dispute resolution.

Q3: Are there extra charges for using UPI, NEFT, IMPS, or RTGS?

UPI is

usually free for consumers. NEFT, IMPS, and RTGS may charge nominal fees for

outward transactions, depending on the amount and bank.

Q4: Is there a cap on how much I can send?

UPI and IMPS

have bank-set limits; NEFT and RTGS offer more flexibility for higher amounts.